Wedbush’s Daniel Ives said it would take three years and $30 billion to move even 10% of the iPhone maker’s supply chain out of China.

Apple, Inc. (AAPL) shares fell by the most since the market downturn seen in the aftermath of the COVID-19 pandemic as investors feared deterioration of fundamentals due to elevated tariffs planned for China and Taiwan, where a majority of its supply chain is located.

Commenting on the tariff impact, Wedbush analyst Daniel Ives said given a vast majority of Apple’s iPhone, 50% of Mac and 75%-85% of iPad production is out of China, the company is flummoxed at the tariffs and left wondering what its next move should be.

According to the analyst, this has agitated investors.

While making note of Apple’s $500 billion domestic investment announced in February, the analyst said it would take three years and $30 billion to move even 10% of its supply chain out of China.

The concept of making iPhones in the U.S. at a $1,000 price point is a “non-starter,” he added.

Ives viewed that making Apple products and iPhones in the U.S. is a fantasy tale and even if they were produced domestically, they will be two to three times more expensive.

The analyst said, “These tariffs in their current form are a shut-off valve for US consumer sales or risk prices going up to levels that are hard to digest.”

That said, Ives persisted with his bullish view on Apple due to its long-term potential. Also the analyst said if the tariffs prove temporary or they are negotiated in some form, the stock is lucrative at current levels, given it now bakes much worse-case scenarios.

Ives has an ‘Outperform’ rating on the Apple stock and a $325 price target.

Separately, BofA Securities analysts on Thursday reduced the price target for the stock to $250 from $260 but kept a ‘Buy’ rating, The Fly reported. The firm’s tempered opinion is premised on a $1.24-per-share impact to calendar year 2026’s bottom-line.

That said, the analyst still thinks Apple is attractive given its relatively defensive nature in the event of an escalation in the global trade war.

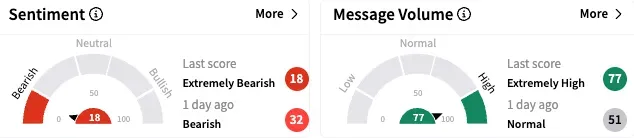

On Stocktwits, retail sentiment toward Apple stock has turned to ‘extremely bearish’ (17/100) by late Thursday from the ‘bearish’ mood that prevailed a day ago. The message volume picked up to ‘extremely high’ levels.

A bearish watcher suggested Apple stock’s “once mighty momentum” has now gone, with mega moves unlikely in the future. Instead, they preferred chasing small and mid-caps.

Another user predicted a move below $100 if tariffs are in effect for a year.

Apple stock settled Thursday’s session down 9.25% at $203.19, the lowest close since June 2024. The stock is now down nearly 19% for the year. From the late-December all-time intraday high of $260.10, the shares have lost nearly 22%.

The pullback has rendered valuations attractive, with the Koyfin-compiled consensus price target of $250.40 pointing to roughly 24% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<