Premier League clubs hit record 6.3 billion-pound revenue in 2023/24, but Deloitte warns of growing financial, regulatory, and fan-driven pressures beneath the surface.

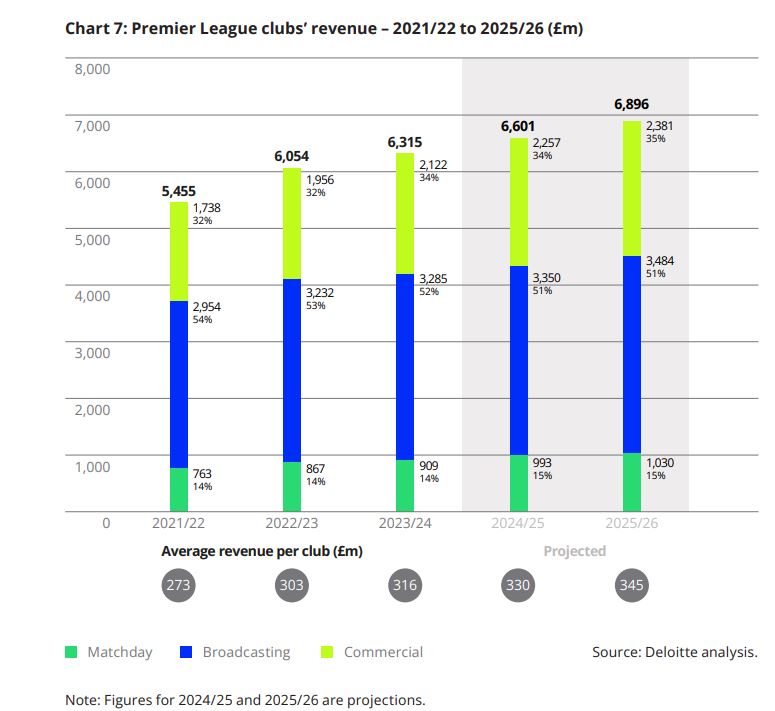

The Premier League's financial might reached new heights in the 2023/24 season, with clubs generating a record 6.3 billion pounds in revenue — a 4% increase from the previous year. However, beneath the surface of commercial growth lies a landscape under increasing pressure from fan unrest, widening inequalities, regulatory uncertainty, and structural imbalances, according to Deloitte's latest Annual Review of Football Finance.

“There can be no doubt that the system in English football is under strain,” said Tim Bridge, Lead Partner at Deloitte’s Sports Business Group.

Commercial Boom Leads the Growth Surge

For the first time, Premier League clubs’ commercial income surpassed 2 billion pounds, driven by global partnerships, merchandise expansion, and enhanced sponsorship deals. Year-on-year growth stood at 8%, with notable contributions from clubs beyond the traditional ‘big six’.

- Nottingham Forest saw a 95% rise in commercial revenue (14 million pounds), thanks to new shirt sponsorship and a landmark kit deal with Adidas.

- Newcastle United, benefitting from a broad commercial strategy, posted an 84% jump (40 million pounds), bolstered by a streaming documentary and stadium expansion plans.

The Premier League’s commercial revenue is projected to reach 2.3 billion pounds in 2024/25, with a final spike expected in 2025/26 due to clubs capitalising on shirt sponsorship opportunities before the gambling partner ban takes effect in 2026/27.

Matchday Income Crosses 900 Million-Pound Mark

Matchday income rose 5% to exceed 900 million pounds, with growth in ticket prices and stadium capacity contributing to the surge. Every club except Tottenham Hotspur posted increases. Spurs' revenue dipped 10% due to absence from European competitions but is set to bounce back following their UEFA Europa League triumph and Champions League qualification for 2025/26.

Deloitte expects matchday income to cross 1 billion pounds in 2025/26, helped by Everton's new Hill Dickinson Stadium and Fulham’s reimagined Riverside Stand.

Broadcasting: Stable but Set for Growth

Broadcasting remained the largest revenue source, increasing marginally to 3.3 billion pounds in 2023/24. UEFA distributions fell 21% to 329 million pounds due to poor progression of English clubs in European tournaments.

The outlook, however, is positive:

- Distributions are expected to rise 25% in 2024/25 with more Premier League clubs in UEFA competitions.

- Chelsea and Manchester City stand to gain up to 90 million pounds each from the expanded FIFA Club World Cup in 2025.

- A new domestic rights cycle from 2025/26 to 2028/29, worth 6.7 billion pounds, will increase the number of live matches from 200 to 270.

- The league’s plan to take international production in-house from 2026/27 is likely to unlock further value.

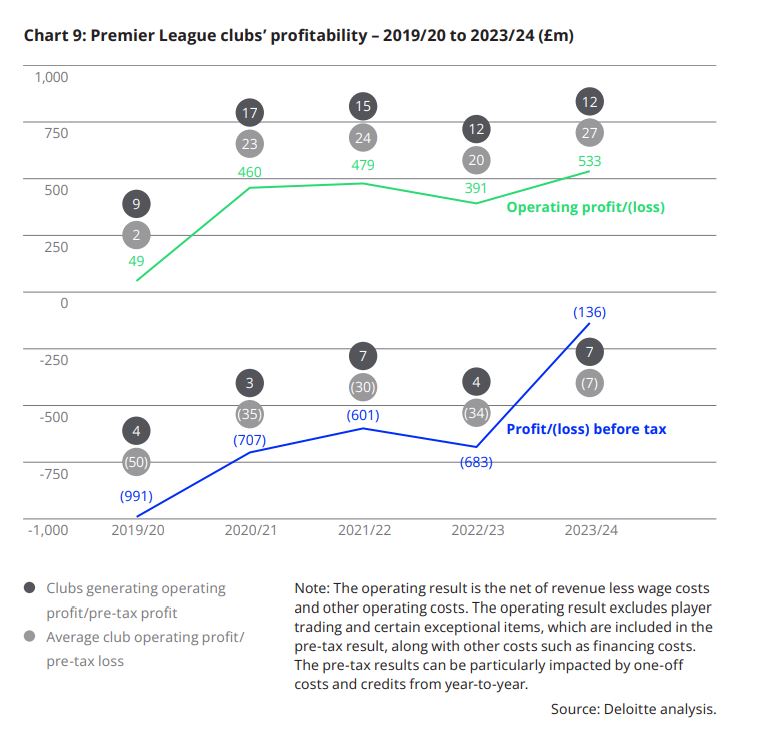

Profitability Up, But Debt Levels Still Rising

Premier League clubs achieved their highest operating profit (0.5 billion pounds) since 2018/19 — a 36% increase year-on-year. Pre-tax losses dropped significantly to 0.1 billion pounds, down from 0.7 billion pounds in 2022/23.

This improvement was supported by:

- 1.2 billion pounds profit from player trading, aided by 250 million pounds from Saudi Pro League clubs.

- 0.2 billion pounds in exceptional credits, including Chelsea’s 199 million pounds gain from restructuring and selling its women’s team.

- Despite profitability gains, net debt rose 12% to 3.5 billion pounds, reflecting stadium investments and squad spending. Everton’s debt jumped by 237 million pounds due to its stadium project, while Fulham’s rose by 142 million pounds.

Equity Injections Overtake Borrowing

To stay within financial fair play boundaries, clubs relied more heavily on equity injections instead of loans, totalling 1.1 billion pounds in 2023/24, up from 0.8 billion pounds in the prior season.

Clubs leading in equity funding:

- Chelsea: 315 million pounds

- Manchester United: 159 million pounds

- Aston Villa: 150 million pounds

- Brighton & Hove Albion: 156 million pounds (via loan-to-equity conversion)

- AFC Bournemouth: 124 million pounds

These moves are supported by UEFA and Premier League financial regulations, which encourage equity funding to cover acceptable losses.

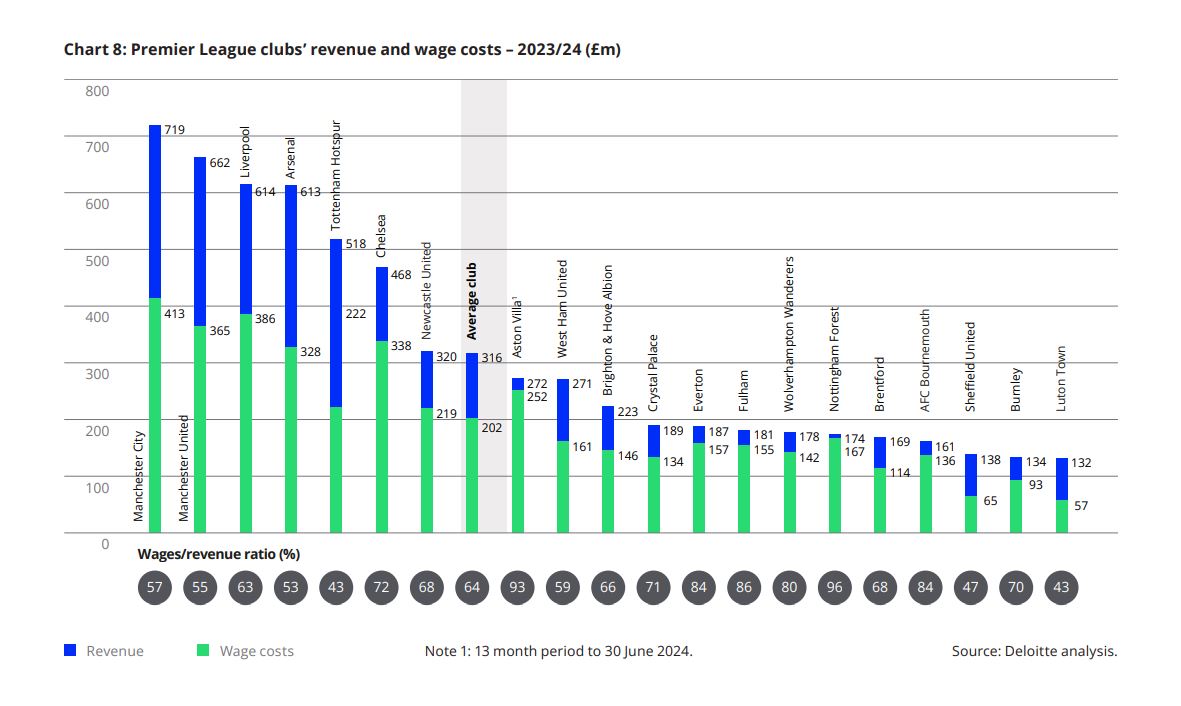

Wage Costs Stabilising Amid Regulatory Pressure

Total wage costs saw only a marginal increase of 8 million pounds, reaching 4 billion pounds. Clubs are under growing regulatory scrutiny, prompting more disciplined spending.

- Arsenal’s wage bill rose 40% to 326 million pounds due to Champions League return bonuses.

- Aston Villa overtook Spurs in wage spend (252 million pounds vs. 222 million pounds) following their historic top-4 finish.

- Tottenham, Luton Town, and Sheffield United had the lowest wage-to-revenue ratios (~43%-47%).

Interestingly, Nottingham Forest and Aston Villa had wage/revenue ratios exceeding 90%, which Deloitte flags as unsustainable. In contrast, the relegation of Leeds, Leicester, and Southampton saw a combined 440 million pounds wage bill replaced by just 215 million pounds among newly promoted sides.

The correlation between league success and wage spending (measured by Spearman’s coefficient) surged to 0.86 in 2023/24, indicating a tighter link between spending and performance.

Promotion Windfalls and the “Yo-Yo” Trap

Promotion to the Premier League continues to deliver transformative financial benefits. Luton Town’s revenue jumped from 18 million pounds to 132 million pounds — a seven-fold increase — although they were relegated again by season’s end.

Fan and investor concerns remain around the “yo-yo effect”, as all three promoted teams were relegated in consecutive seasons, highlighting financial instability and competitive imbalance.

“The financial implications of the 'yo-yo effect' on clubs, their spending, and overall competitiveness are major factors to address in order to continue attracting high levels of investment,” said Bridge.

Fans Push Back: Ticket Pricing and Identity Crisis

Despite financial growth, stadiums have become hotspots for fan discontent. Ticket price hikes, limited access for locals, and prioritisation of tourist fans have sparked widespread protests across the league.

“Repeated reports of fan unrest at ticket price and accessibility demonstrate the challenge… of balancing commercial growth with the historic essence of a football club's role and position in society: as a community asset,” Bridge warned.

Independent Regulator Incoming: New Era of Oversight

Set to be legislated in 2025, the Football Governance Bill will establish an Independent Football Regulator focused on ensuring financial sustainability. The full implications remain unclear, especially with unresolved cases such as Manchester City’s financial charges still pending.

Clubs are increasingly calling for regulation that is “robustly and appropriately designed, and then enforced in a timely and respectful manner,” per Deloitte.

Despite positive indicators like profitability, commercial strength, and broadcast expansion, Deloitte warns that future growth will be limited without “bold and innovative changes.”

A potential transition to a direct-to-consumer (D2C) model and increased collaboration between clubs could unlock new value. But Deloitte cautions that a reluctance to prioritise collective progress over individual gain may hold the league back.