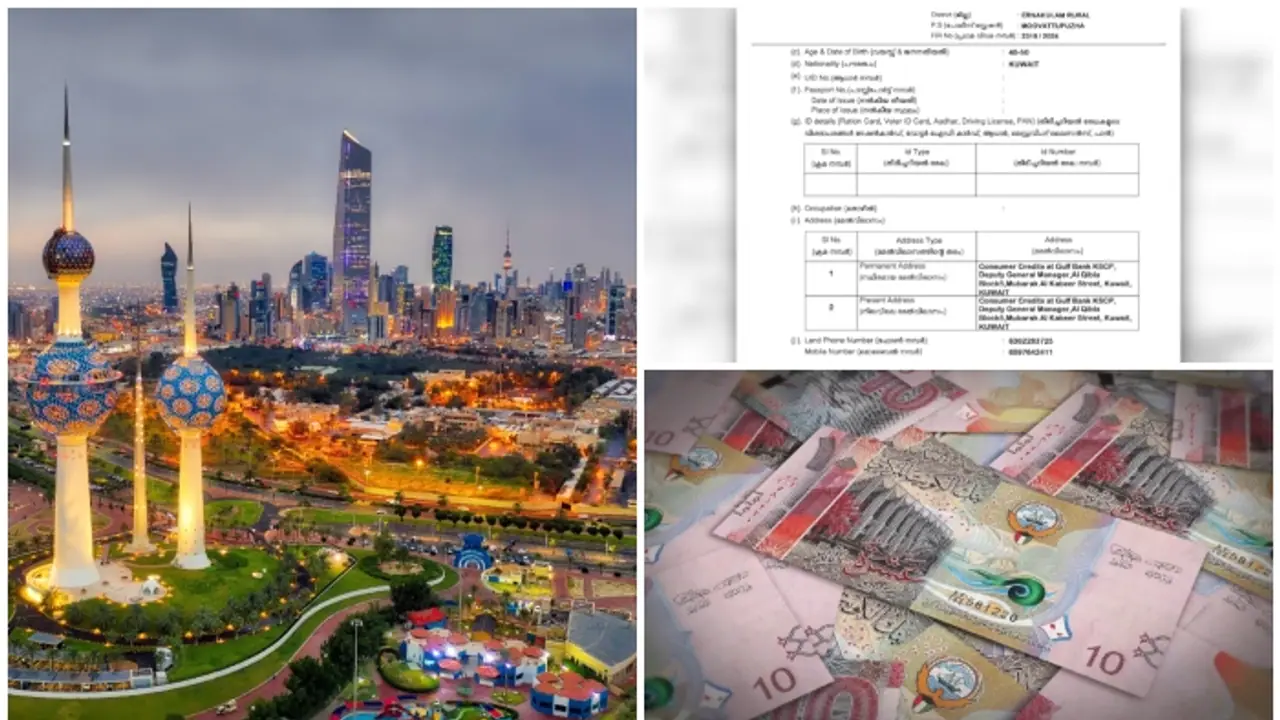

The Home Ministry has initiated an investigation into a massive loan fraud involving 700 Malayalis who took out loans from Gulf Bank in Kuwait and absconded after defaulting on repayments.

New Delhi: The Ministry of Home Affairs has intervened in the case involving 1,425 Malayalis who absconded after taking loans from a bank in Kuwait without repaying them. The Ministry has launched an investigation into the incident and is seeking details of the individuals who took the loans and fled Kuwait. According to bank officials, approximately Rs 700 crore was borrowed, and the individuals disappeared after obtaining the loans.

The Union Home Ministry has directed the bank authorities to provide full details of the individuals involved. In response, the Gulf Bank of Kuwait officials stated that they would give a reply after further discussions. Meanwhile, the central government has gathered details of ten registered cases from the police. Bank officials, who are expected to arrive in Kerala next week, will provide additional complaints.

The incident came to light when the Deputy General Manager of Gulf Bank traveled to Kerala and filed a complaint with the ADGP responsible for law and order. The investigation has revealed that most of the 1,425 Malayalis involved in the scam are nurses. Gulf Bank authorities have informed the state police that around 700 Malayali nurses are believed to have committed the fraud. After taking large loans, these individuals are said to have migrated to other countries.

Authorities reported that after securing loans from Gulf Bank in Kuwait, many of these individuals relocated to countries like the United States, Canada, and the UK, in addition to returning to Kerala.

The Gulf Bank officials informed Kerala police that the fraudulent activities took place between 2020 and 2022. It was revealed that around 700 people, including Malayali government employees in Kuwait and nurses working in the Ministry of Health, had taken loans from the bank and then fled.

Initially, the accused borrowed small amounts, repaid them on time to boost their credit scores, and later took out larger loans, disappearing afterward. Each loan ranged from Rs 50 lakh to over Rs 2 crore. The bank began its investigation after noticing delays in repayment.