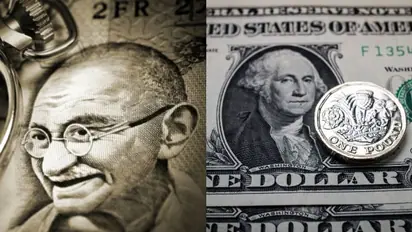

Indian Rupee Vs US Dollar: Can India manage the currency turmoil?

Synopsis

Even as domestic inflation would weigh in, several export restrictions by way of levies and other measures need to be reviewed at regular intervals, says economic expert Prakash Chawla

The one-way journey of the US dollar against most currencies, including the Euro, Yen, Yuan and the Indian Rupee, among several others, reminds me of a Dhanush number a decade ago -- Why this Kolaveri... Kolaveri... Kolaveri... Kolaveri Di? Millions seem to be humming the Tamil song at the moment.

The Kolaveri around the dollar rise is hardly fun; it is sending global inflation to levels unheard of, at least in the developed countries like the United States, for several decades. Over nine per cent inflation is so unbearable for Americans that the Federal Reserve is behaving as if it is tasked with putting off wildfires with unprecedented 40-plus degree Celsius temperatures in Europe.

Also Read: EPFO payroll: Provident fund organisation adds close to 17 lakh subscribers in May

Other central banks, including the Reserve Bank of India, are reacting to the hawkish tones of the US Fed, while the investor community is finding a safe haven, not so much in gold but in the US Dollar.

Isn't it a paradox that the US Dollar Index is shooting up when it is almost a given that the US economy is slipping into a recession, sending other currencies into a tizzy?

Common sense suggests that the currency of an economy downhill should also move downward, but then common sense does not apply to the US Dollar. After all, it is the only reserve currency in the world. Every central bank, corporate or individual feels rich with this currency, similar to gold!

Let's now see how the Indian Rupee has fared vis-a-vis the USD. The INR has depreciated about 7 per cent in the calendar 2022 and 4 per cent in the FY'23 to date. To that extent, it definitely impacts what is known as the 'imported inflation' in the form of crude oil imports and its cascade besides other essential imports.

On the other hand, exporters benefit from inward remittances translating into higher rupee accruals from a stronger dollar; most Indian exports, both merchandise and services, are tagged to the US Dollar. Since India is a net importing country with an unsustainable current account deficit of three per cent, this 'Kolaveri' is around the currency weakness! Of course, there are political noises seeking to score points against the Narendra Modi Government. That is quite understandable in a vibrant democracy.

The bigger question is: Can India manage the currency turmoil? We can get some solace from the fact that all other currencies are losing against the greenback. At the end of the day, we have to manage our resources diligently.

We have the resource reserve in the form of $580 billion, which sounds comforting only in a situation when the inflows and outflows are more or less evenly balanced. We are currently in a phase where capital outflows remain unabated, and higher imports lead to a widening trade gap. As per the June data, the trade deficit widened to a record monthly level of $26.1 billion, a 172 per cent increase yearly.

What does the trajectory look like, and what is expected from the government and the RBI?

The Reserve Bank has already taken some credible measures, including facilitating international trade in INR, pegged to the local currency of a partner country through a Vostro mechanism. Besides, it has announced steps for promoting capital inflows from foreign fund managers and non-resident Indians.

The RBI surely has a few more arsenal to deal with the fast-evolving global landscape. On its part, the government is expected to come out with restrictions on imports while promoting exports which become more competitive in a falling rupee scenario.

The key is to bridge an import-export gap through an item-by-item approach. Even as domestic inflation would weigh in, several export restrictions by way of levies and other measures need to be reviewed at regular intervals. Imports should be restricted so that a minimum impact is felt on the intermediary industries for their requirements of essential raw materials and components. What is certain: Expect announcements on these lines.

Meanwhile, Kolaveri... Kolaveri... would continue to play, maybe in a shrill tone!

Also Read: Work from home to be allowed in SEZs, may be extended up to 50% employees; Details here

The author is a New Delhi-based independent journalist. Views experessed are personal.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.