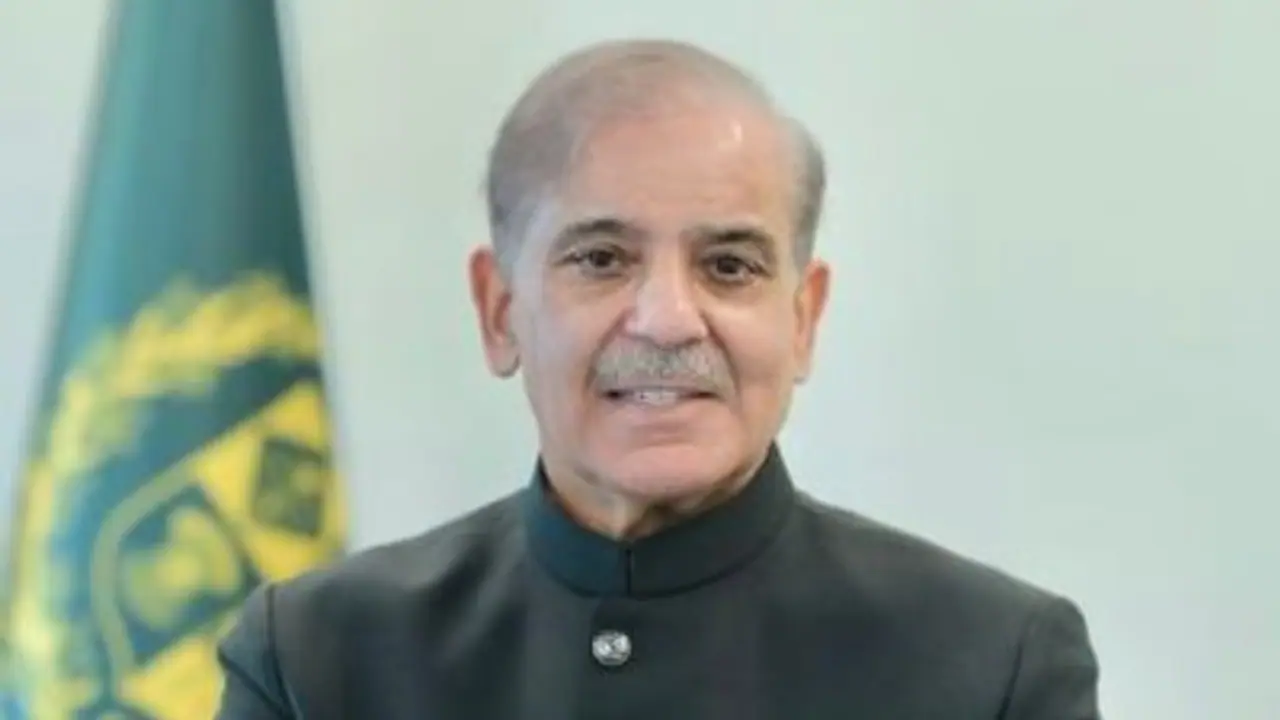

Cash-strapped Pakistan, under the leadership of Prime Minister Shehbaz Sharif, unveiled plans on Tuesday to privatise all state-owned enterprises, including the struggling Pakistan International Airlines.

Cash-strapped Pakistan, under the leadership of Prime Minister Shehbaz Sharif, unveiled plans on Tuesday to privatise all state-owned enterprises, including the struggling Pakistan International Airlines. This move represents a significant broadening of the government's initial strategy, which solely targeted loss-making state firms for privatisation.

The announcement to privatise state-run enterprises, with the exception of strategic ones, coincided with Pakistan's commencement of negotiations with the International Monetary Fund (IMF) for a new long-term Extended Fund Facility (EFF).

Sharif made the announcement while presiding over a review meeting on the privatisation process of loss-making state-owned enterprises (SOEs), as reported by media outlets.

During the meeting, Sharif emphasized that, besides strategic state-owned firms, all other enterprises—whether profitable or loss-making—would undergo privatisation, as per Geo News.

Asserting the government's role in fostering a business and investment-friendly environment, Sharif directed all ministries to actively participate and cooperate with the Privatisation Commission in executing the privatisation agenda.

Highlighting the imperative for transparency in the privatisation endeavors, Sharif mandated that the privatisation proceedings of Pakistan International Airlines (PIA) be televised, encompassing the bidding process and other pivotal stages. The report indicated that PIA's privatisation is nearing its culmination.

As Pakistan's ailing national flag carrier, PIA emerged as the third-highest public sector loss-making entity in the country, necessitating a monthly outlay of Pakistani Rs 11.5 billion solely for debt servicing.

Additionally, the report indicated that the privatisation processes of other institutions would also be broadcast live.

During the meeting, a roadmap outlining the Privatisation Programme 2024-2029 was presented, as per The Express Tribune newspaper.

Ministers were apprised that the privatisation of loss-making SOEs would receive precedence, with the Privatisation Commission in the process of appointing a pre-qualified panel of experts to expedite the sell-off process, the report elaborated.

Under the leadership of Prime Minister Sharif, the government has intensified efforts to privatise several state-owned enterprises as a means to alleviate the burden on the exchequer and address the prevailing financial challenges.

Previously, debt-laden Pakistan had intended to privatise solely loss-making state-owned enterprises, as reported by Dawn newspaper.

During the Pre-Budget Conference 2024-25, Finance Minister Muhammad Aurangzeb underscored the necessity of privatisation for attaining economic stability in the country.

Addressing the imperative of moving towards privatisation for economic stability, Aurangzeb emphasized the government's commitment to this path.

Deputy Prime Minister Ishaq Dar stated last week that the government would confine its involvement to strategic and essential state-owned enterprises, reducing their number from 40 following thorough scrutiny.

Privatisation has long been advocated by the Washington-based IMF as a measure for Pakistan, which grapples with a significant fiscal shortfall.

Despite narrowly avoiding default last summer, Pakistan's economy has stabilized post the completion of the previous IMF program, with inflation declining to approximately 17 per cent in April from a peak of 38 per cent in May the previous year.

Nonetheless, the nation continues to contend with a substantial fiscal deficit. While import control measures have curbed the external account deficit, this has been at the expense of stifling growth, which is anticipated to hover around 2 per cent this year, contrasting with negative growth observed last year.