Introducing Bajaj Finserv. With nearly two decades in the industry, Bajaj Finserv is a leading Non-Banking Financial Company (NBFC) known for its financial services, including lending, investment, insurance, bill payments, and more.

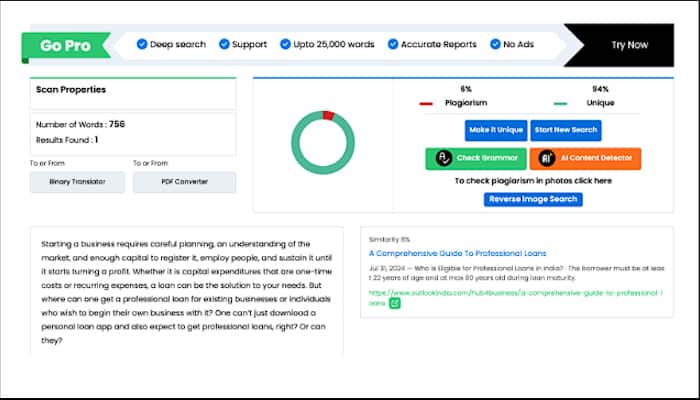

Starting a business requires careful planning, an understanding of the market, and enough capital to register it, employ people, and sustain it until it starts turning a profit. Whether it is capital expenditures that are one-time costs or recurring expenses, a loan can be the solution to your needs. But where can one get a professional loan for existing businesses or individuals who wish to begin their own business with it? One can’t just download a personal loan app and also expect to get professional loans, right? Or can they?

Introducing Bajaj Finserv. With nearly two decades in the industry, Bajaj Finserv is a leading Non-Banking Financial Company (NBFC) known for its financial services, including lending, investment, insurance, bill payments, and more. With Bajaj Finserv, you can get a professional loan from ₹2 Lakhs to ₹80 Lakhs without any collateral and from ₹1 Lakh to ₹1.05 Crore with security for all of your small and large expenses.

Why take a CA loan over a personal loan?

In addition to professional loans such as CA loans, professionals can also be eligible for personal loans. But why should one look for a professional loan instead when personal loans are an option? While professionals can also qualify for personal loans for the same amount at the same interest rate, additional benefits like zero prepayment, no foreclosure charges, and low processing fees make a professional loan an attractive option.

In addition to this, one thing to remember is that professional loans start at a lower interest rate due to the credibility of a professional and can have a higher ceiling as opposed to personal loans. These loans also have much more flexibility in terms of repayment.

What are the eligibility criteria for CA loans from Bajaj Finserv?

Individuals looking for an easy way to get a professional loan to advance their careers or set up a new business can easily do so by checking out the eligibility criteria for the loan. Whether you are a CA, doctor, engineer, or lawyer, keep in mind that every lender has different eligibility requirements when offering their loans in addition to certain standard documentation.

Here is a list of some of the eligibility requirements and documents required to apply for a CA loan from Bajaj Finserv:

The borrower must be at least 22 years of age and at max 80 years old during loan maturity.

The borrower must be of Indian Nationality.

The borrower must have a good credit history and a decent credit score of at least 685.

The borrower must have an Aadhar, Passport, Voter ID, Driver’s license, etc for KYC.

The borrower must have a PAN card.

The borrower must have profession-specific proof such as a CA license, etc.

The borrower must have education certifications or degrees in chartered accounting.

The borrower must have bank statements from a few years with positive cash inflow.

The borrower must have Income Tax returns.

The borrower’s business must have a profitable profit and loss account of at least two years.

How do you get a CA loan from Bajaj Finserv?

Once you fulfil the above requirements, getting a CA loan in India is quite simple; all it requires is for you to download the Bajaj Finserv application from the Apple App Store or Google Play Store and follow the given steps to get a loan ranging from ₹1 Lakh to ₹1.05 Crores (Depending on if you go for a secured vs unsecured loan):

Sign up using your phone number and email address

You'll see the 'Loans' section on the home page below the search bar.

Tap on it and select the right loan for your needs. As a CA, you can choose “Loan for Chartered Accountants.”

Enter the required information as KYC and submit any relevant documents to apply for the loan.

Bajaj Finserv’s commitment to offering its customers the best lending solutions and customer-centric approach makes the Bajaj Finserv app a super app for all your financial needs. Whether all you are looking for is a professional loan, personal loan, gold loan, investment options in stocks, mutual funds, fixed deposits, bill payments, or more, take control of all of your financial needs with Bajaj Finserv.

The Bajaj Finserv app is available for download on all major platforms, including the Apple App Store and Google Play Store, making it easily accessible to a broad audience. For more information about CA loans, download the Bajaj Finserv app and check out all that Bajaj offers, including a loan and EMI calculator to plan your decisions accurately.