Cyber security companies’ near-term trends are mixed but lean toward a “more cautious” outlook, with commentaries pointing to large deal delays.

Cybersecurity player Zscaler, Inc. ($ZS) is scheduled to announce its fiscal-year 2025 first-quarter results after the market closes on Monday, and retail sentiment remained sour in the run-up to the event.

The San Jose, California-based company is widely expected to report non-GAAP earnings per share (EPS) of $0.63, lower than the year-ago’s $0..67 and the previous quarter’s $0.88.

Analysts, on average, expect revenue of $605.52 million compared to the $496.7 million and the $592.9 million, respectively, reported for the year-ago and the previous quarters.

The guidance issued in early August calls for non-GAAP EPS of $0.62-0.62 and revenue of $604 million-$606 million

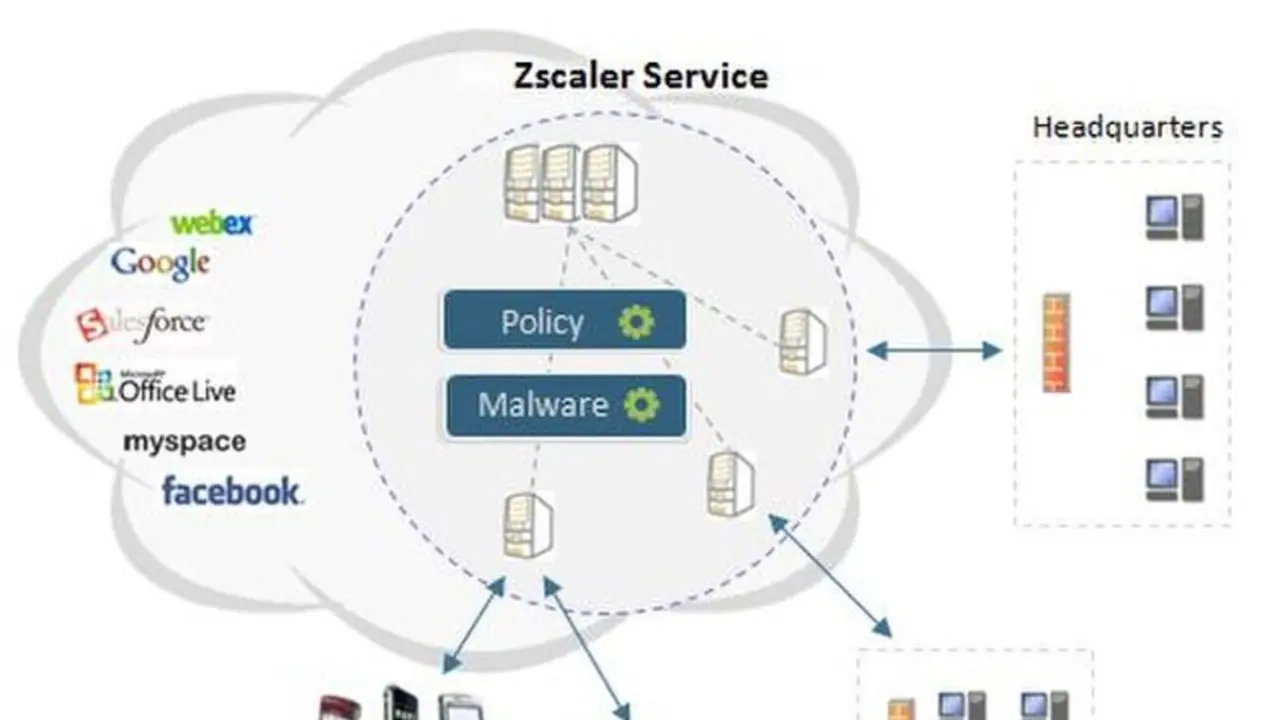

In the preceding quarter, the company’s calculated billings grew 27% year-over-year (YoY) and deferred revenue was up 32%. The company said in August that its cloud platform surpassed over half a Trillion transactions daily. "I'm excited about the year ahead, as we enter Fiscal 2025 with a strong go-to-market machine and a high pace of innovation," CEO Jay Chaudhry had said then.

Zscaler currently expects full-year non-GAAP EPS of $2.81-$2.87 and revenue of $2.60 billion-$2.62 billion.

Most Wall Street analysts raised their price targets for the stock ahead of the company’s quarterly results, according to the Fly. Jefferies analysts hiked the price target from $225 to $245, while maintaining a “Buy” rating. The analysts said the company can meet its conservative first-quarter YoY billings growth guidance of 10%.

Raising the price target from $205 to $238, BTIG analyst Gray Powell said channel checks showed the security space’s performance down-ticking sequentially. Cyber security companies’ near-term trends are mixed but lean toward a “more cautious” outlook, with commentaries pointing to large deal delays, he said.

Partners continue to see a stable competitive environment in large enterprise secure service edge deals and generally view Zscaler as a mid 20's grower for the next year, BTIG said.

Zscaler shares ended Wednesday’s session down 2.54% at $204.96, with the year-to-date returns at a negative 7.49%

Earlier this week, peer CrowdStrike, Inc. ($CRWD) reported better-than-expected quarterly results and raised its full-year guidance, and yet the stock retreated sharply.

On the Stocktwits platform, sentiment toward Zscaler stock was ‘bearish’ ahead of its earnings print.