The SEC's acknowledgment of a Solana ETF application and new XRP ETF filings have fueled speculation that both cryptocurrencies could be next in line for institutional adoption.

XRP and Solana (SOL) were among the top-performing major cryptocurrencies during U.S. trading hours on Friday, with XRP climbing 5.6% and Solana gaining 4.3% in the last 24 hours.

In comparison, Bitcoin (BTC) saw a modest 1.6% increase.

Both tokens are at the center of renewed speculation over potential spot exchange-traded funds (ETFs), with growing momentum behind regulatory approvals.

The U.S. Securities and Exchange Commission (SEC) formally acknowledged an application for a Solana-based ETF on Wednesday, the same day four fund managers submitted filings for XRP-backed funds.

The approval of spot Bitcoin ETFs in January last year and subsequent filings for Ethereum ETFs have paved the way for additional crypto assets to enter the ETF market.

Crypto investors are closely watching U.S. regulatory trends, particularly amid speculation that a second Trump presidency could be more favorable for digital assets.

However, Trump's recent meme coin launch has raised ethical concerns about potential conflicts of interest.

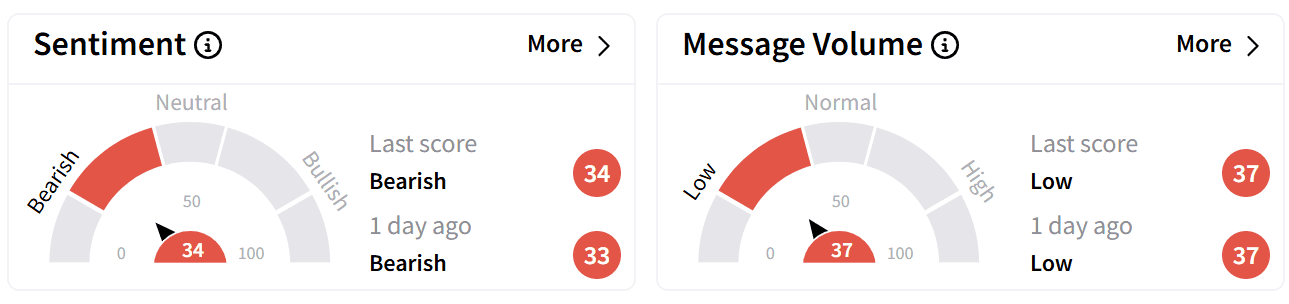

On Stocktwits, retail sentiment around Solana continued to be ‘bearish’ accompanied by ‘low’ levels of chatter.

Some users of the platform believe that the crypto bull run is done for the year.

Solana continues to gain traction as a high-utility blockchain network.

The platform has established itself as a major player in decentralized finance (DeFi) and has been the preferred chain for the recent memecoin trading surge, which saw billions in trading volume.

JPMorgan even warned that Solana’s growing dominance could erode Ethereum’s (ETH) market share, adding another layer of interest in its ETF prospects.

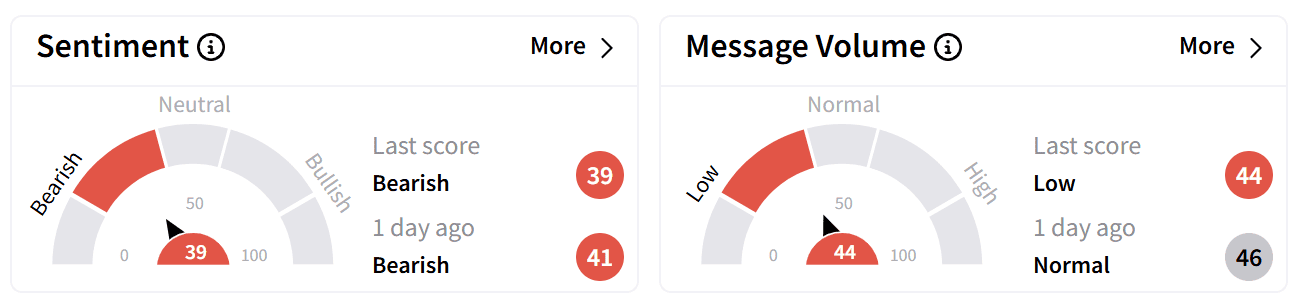

Retail sentiment on Stocktwits around XRP was also ‘bearish’ with message volume decreasing to ‘low’ from ‘normal’ levels a day ago.

One user pointed to technicals showing a “head and shoulders” pattern forming, which usually depicts a bullish-to-bearish trend.

According to Stocktwits data, XRP was the most active ticker on the platform over the past 24 hours, with a sharp increase in message volume over the last two weeks.

A key factor supporting XRP ETF applications is Ripple’s partial legal victory in July 2023, in which a court ruled that programmatic sales of XRP to retail investors did not constitute securities transactions.

The SEC has appealed the ruling to the Second Circuit, with the outcome potentially influencing the ETF approval process.

Leading asset managers — WisdomTree, Bitwise, 21Shares, and Canary Capital — have submitted applications for spot XRP ETFs with the Cboe BZX Exchange.

If approved, these funds could provide a new avenue for institutional investors to gain exposure to XRP, further legitimizing its place in the digital asset market.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Bitcoin Tops $100K Again, But Weaker-Than-Expected Jobs Data Drags Crypto Down — Retail Confidence Dips