For Q1, the company earned $0.20 per share, on an adjusted basis, on $663 million in revenue, which rose 6.2%. Both the top and bottom lines missed analysts' estimates.

WK Kellogg (KLG) cut its sales and core profit expectations for the year on Tuesday after a dull first quarter but said it saw healthy demand for some of its nutrition-focused food products.

The company, already seeing a pullback in demand for its cereals after raising prices in recent months, faces further risks from inflationary pressure amid aggressive U.S. trade policies.

"Sentiment is obviously down," Gary Pilnick said on the analyst call.

WK Kellogg shares gained 3.3% to $17.93 on Tuesday.

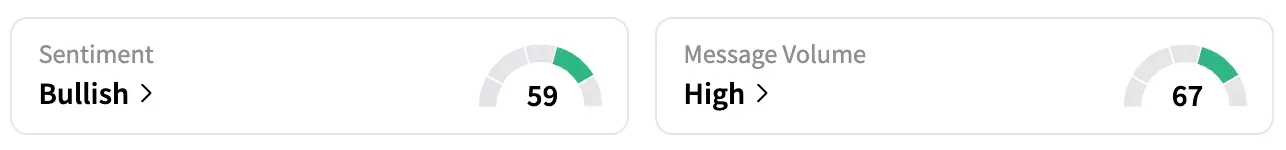

On Stocktwits, retail sentiment for the company flipped to 'bullish' from 'bearish' the prior day.

Users expressed confusion over gains in the stock after the company's unimpressive quarterly report.

WK Kellogg now expects full-year organic net sales to decrease between 2% and 3%, compared to its prior forecast of a 1% fall.

The company sees adjusted core earnings of between $270 million and $275 million, compared with the previous target of between $286 million and $292 million.

For Q1, the company earned $0.20 per share, on an adjusted basis, on $663 million in revenue, which rose 6.2%. Both the top and bottom lines missed analysts' estimates.

WK Kellogg, established in 2023 following its separation from Kellanova (K), specializes in ready-to-eat cereals across North America.

Its portfolio features iconic brands like Frosted Flakes, Special K, Froot Loops, Raisin Bran, and Kashi.

Over the past year, the company has faced challenges due to declining cereal consumption and shifting consumer preferences.

In response, WK Kellogg has been investing in supply chain modernization and introducing health-focused products.

The company's shares are nearly flat this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<