The advance first-quarter GDP estimate released late April showed that the economy contracted at a 0.3% rate, with the weakness stemming primarily from an increase in imports.

Stocktwits users have become hopeful that the economy will skirt a recession following recent positive developments. The U.S.-China trade talks and recent tech deal news flowing out of the Middle East have apparently allayed retail traders' concerns.

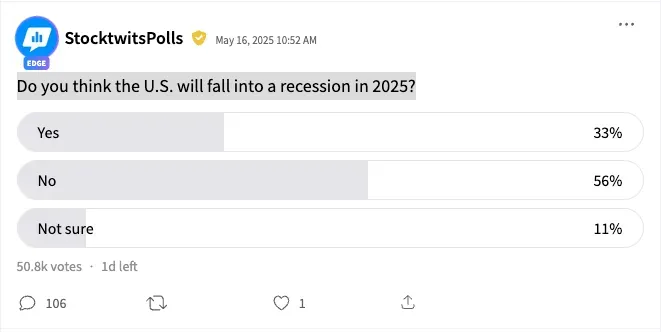

A poll asking users “Do you think the U.S. will fall into a recession in 2025?” received responses from nearly 51,000 users and 106 comments.

Most users (56%) said a recession is unlikely, 11% said they were unsure, and 33% foresaw a recession.

The latest results compare favorably with Stocktwits’ previous poll. In mid-March, when the market trended lower, 31% said there were “too many warning signs of a recession,"and 17% said the economy was already in a recession. About one-fifth of the respondents said President Donald Trump’s policies will decide where the economy will head.

That was when the Trump administration tested waters via sweeping tariffs with major trading partners. The president made good his promise and announced punitive levies, although he later put the implementation on hold. But he proceeded with a vindictive stance against China, ratcheting up tariffs to 145%,

After a series of moves and countermoves, both nations decided last week to suspend the implementation for 90 days.

Among those respondents who commented on the poll, one bullish watcher said they already bought the dip, suggesting they expect better times ahead.

Another sounded uber-bullish. “We are more than capable of working our way out of anything close to a recession. We are reaching all-time energetic highs,” they said.

An artificial intelligence (AI) bull said, “No way, impossible. NVDA WILL NOT LET THAT HAPPEN GO AI.” Nvidia (NVDA) shares recovered nicely last week after a series of AI investment deals struck with the Middle East.

Some users, however, opined that the U.S. economy was already in a recession or was hurtling toward one. One of them said, “Q1 already had negative GDP, much less trading in Q2, of course negative GDP again.”

The advance first-quarter GDP estimate released late April showed that the economy contracted at a 0.3% rate. The weakness stemmed primarily from an increase in imports due to exporters pulling forward purchases ahead of the Trump tariffs kicking in.

Data available in betting sites has shown a scaling back in recession odds. Polymarket data shows the recession odds at 38%, down from the 66% probability at the start of May.

Following the U.S.-China trade deal, JPMorgan economists said the firm’s recession odds, though remaining elevated, have fallen below 50%. That is down from the 60% probability the firm predicted in mid-April.

The Invesco QQQ Trust (QQQ) ETF, an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index, is up 2.2% for the year, while the broader SPDR S&P 500 ETF (SPY) has gained 1.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<