The SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index, rallied nearly a percent on Monday before settling at $600.15, off its all-time high of 613.23.

The stock market has remained resilient despite the geopolitical tensions and macro uncertainty that President Donald Trump’s tariff policy engendered.

The S&P 500 Index, a measure of broader market performance, has gained over 2.4% this year. It is slowly and steadily edging toward its Feb. 19 all-time highs of 6,147.43, having closed Monday’s session at 6,025.17.

The SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the S&P 500 Index, rallied nearly a percent on Monday before settling at $600.15, off its all-time high of 613.23.

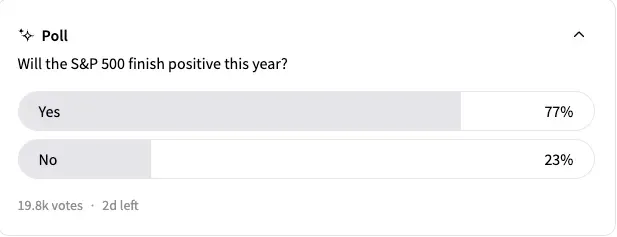

Despite the pushbacks, Stocktwits users are largely bullish about the trajectory of the SPY. A poll among platform users that asked, “Will the S&P 500 finish positive this year?” found that more than three-fourths of the respondents (77%) predicted a positive close. About one-fourth (23%) were bearish, as they saw the ETF ending lower for the year.

The poll received responses from nearly 20,000 users.

Tech stocks have outperformed the broader market, as reflected by a 4.3% gain for the tech-focused Invesco QQQ Trust (QQQ) ETF.

With the half-year mark nearly in, the market is left to contend with several risk events. The tariff pause Trump announced is set to end early next month. A lack of resolution could bring recession talks back on the table and the specter of renewed inflationary pressure.

The ongoing geopolitical tension in the Middle East is also a headwind, given its potential to increase oil prices. This, in turn, will stoke inflationary pressure, which hovered above 9% in the summer of 2022 but has since been contained following a series of rate hikes by the Federal Reserve.

These uncertainties have prevented the Fed, under Chair Jerome Powell, from lowering the Fed funds rate despite political pressure to do so.

In a report released Sunday, Morgan Stanley’s Chief Equity Strategist Mike Wilson said that the effect of the geopolitical tensions is only transient. He also flagged corporate earnings momentum and positive operating leverage as stock tailwinds.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<