From the April 7 low, the broader market gauge has gained 25%.

The stock market continues to make slow and steady progress in a new bull run that followed its recovery from the Trump-tariff lows. Analysts and strategists, meanwhile, are mixed about the near-term market trajectory.

The S&P 500 Index hit an all-time peak of 6,147.43 (intraday) on Feb. 19, with the closing high being 6,144.15, thanks to hopes of continued corporate earnings momentum, underpinned by artificial intelligence (AI) technology.

Traders also factored in favorable deregulation and taxation policies from the Trump administration.

However, things worsened when Trump began sounding out stringent tariffs to penalize trading partners with restrictive policies. He made good his promise by announcing sweeping tariffs, although he rolled back much of it a week later, leaving only the 10% base levy in place.

Ahead of the pause, the S&P 500 Index slumped to a low of 4,835.04, a peak-through drop of 21%. A 20%+ drop technically meant the index was in bearish territory.

But since then, it has been on the road toward recovery. From the April 7 low, the broader market gauge has gained 25%.

The recent market recovery has emboldened traders to hope the S&P 500 will retest its record high.

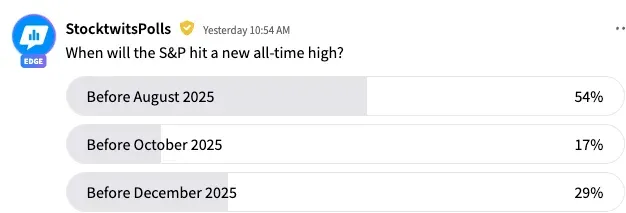

An ongoing Stocktwits poll that asked users “When will the S&P hit a new all-time high?” received responses from over 14,000 people.

Most (54%) expect the index to topple the previous high before August. A far smaller 17% see a new high coming before October, and 29% predict a longer timeline (before December).

Crunching historical data, the strategist said the index generated average and median 12-month returns of 9.7% and 8.6%, respectively, after a new high was hit. Furthermore, he added that 74% of the 25 analyzed periods produced positive returns over the 12-month period.

However, Morgan Stanley Chief Investment Strategist Lisa Shalett is skeptical. According to the strategist, the new bull market is on shaky ground.

Shalett said geopolitical tensions and legislative uncertainties, including debates on bank regulations and the U.S. tax bill, pose risks to the equity rally.

Also, the market’s optimism on earnings and growth lacks evidence, as CEO confidence drops, cost pressures rise, and capital spending wanes, she added.

The Morgan Stanley analyst may not be way off in her predictions. As Israel launched a series of strikes against Iranian nuclear installations early Friday, all risky financial bets tumbled.

At the time of writing, the Nasdaq 100 futures fell 1.46%, and the S&P 500 futures were down about 1.20%.

The Invesco QQQ Trust (QQQ) ETF and the SPDR S&P 500 ETF (SPY) are up 4.5% and 3.3%, respectively, for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.