Gorilla Tech, SMCI, Nvidia, GameStop, and Palantir Tech drew some of the most positive responses from poll participants. Interestingly, retail investors were not so optimistic about Tesla.

It’s not been an excellent year for equity investors as much of their optimism about easing interest rates was overshadowed by President Donald Trump’s tariff wars, the resulting impact on inflation, and a looming fear of recession. Major U.S. indices have recorded losses on a year-to-date basis, with the Dow falling about 1% and the Nasdaq Composite tumbling over 9% in 2025.

On Stocktwits, we took this opportunity to analyze which stocks retail investors are most enthusiastic about—the ones they’d readily recommend to friends. In the process, we also uncovered the market’s least talked-about names. Here’s a closer look at how retail sentiment shapes these popular tickers.

1. Gorilla Technology (GRRR): The company is among the most popular names on Stocktwits. Eighty-four percent of the poll respondents said they would recommend the name to their friend. Only 16% remained skeptical about the stock.

The London-headquartered firm is a global solution provider in Security Intelligence, Network Intelligence, Business Intelligence and IoT technology space.

Gorilla Technology has been in the news lately after the company reported a 15.4% year-over-year (YoY) to $74.67 million, topping a Wall Street estimate of $71.22 million. Adjusted earnings per share (EPS) came in at $2.02, way higher than the estimated $0.35.

2. Super Micro Computer (SMCI): Eighty-two percent of poll respondents said SMCI is a stock they would recommend to a friend this year. Just 18% of the surveyed respondents remain skeptical about its potential.

SMCI has been in the news lately after Goldman Sachs downgraded the stock to ‘Sell’ from ‘Neutral’ and reduced the price target to $32 from $40.

Meanwhile, Fortune reported that short sellers have built a $4 billion position against the server manufacturer.

3. Nvidia (NVDA): Nvidia has never faced a dearth of investor interest in recent years. However, there was renewed interest in the stock on Wednesday after The Information reported that Chinese firms, including the likes of Alibaba, ByteDance, and Tencent Holdings, have ordered $16 billion worth of its H20 server chips from the company.

On Stocktwits, 77% of the poll respondents believe the stock is worth a recommendation.

4. GameStop Corp (GME): The video game retailer has been a favorite retail stock ever since the short squeeze saga. The company has been in the news lately after it completed its private offering of $1.5 billion aggregate principal amount of zero percent convertible senior notes due 2030.

GameStop had said it intends to use the proceeds for general corporate purposes, including acquiring Bitcoin.

A Stocktwits poll revealed that 74% of the surveyed respondents are positive on the stock, while 11% said they would recommend it “to an enemy.”

5. Palantir Technologies (PLTR): Despite major indices trading in the red this year, Palantir stock has recorded gains year-to-date. Investors are closely watching the stock as uncertainty surrounding government funding cuts has raised concerns.

Morgan Stanley has reportedly sounded caution on the stock, as a potential recession following Trump’s tariffs could negatively impact the shares.

However, 72% of respondents surveyed in a Stocktwits poll believe the stock is worth recommending. The rest, however, align with Wall Street’s cautionary stance.

6. Intel (INTC): Most retail investors are bullish on the chipmaker for the year. The stock drew investor attention on Wednesday after CEO Lip-Bu Tan reportedly said the company would spin off assets that aren’t central to its mission.

Tan also said Intel would create new products, including custom semiconductors, to better align itself with customers.

According to a Bloomberg report, Tan spoke at his first public appearance as CEO at the Intel Vision conference Monday in Las Vegas.

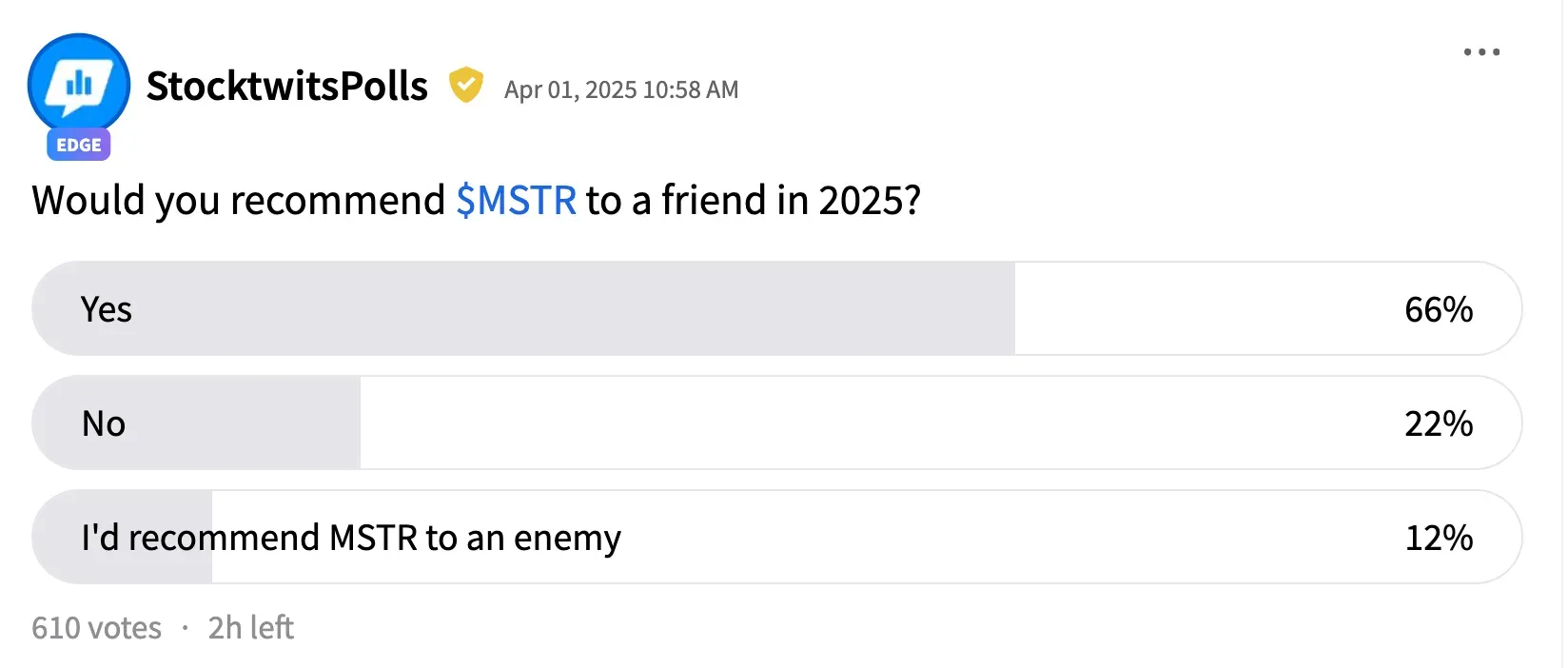

7. Strategy (MSTR): The company, earlier known as MicroStrategy, has been in the news lately after it announced its largest Bitcoin (BTC) purchase of the year, acquiring 22,028 of the apex cryptocurrency.

The latest acquisition brought its total holdings to 528,165 BTC, roughly 2.5% of all Bitcoin that will ever be issued.

The majority of the respondents to the Stocktwits poll have an optimistic take on the poll.

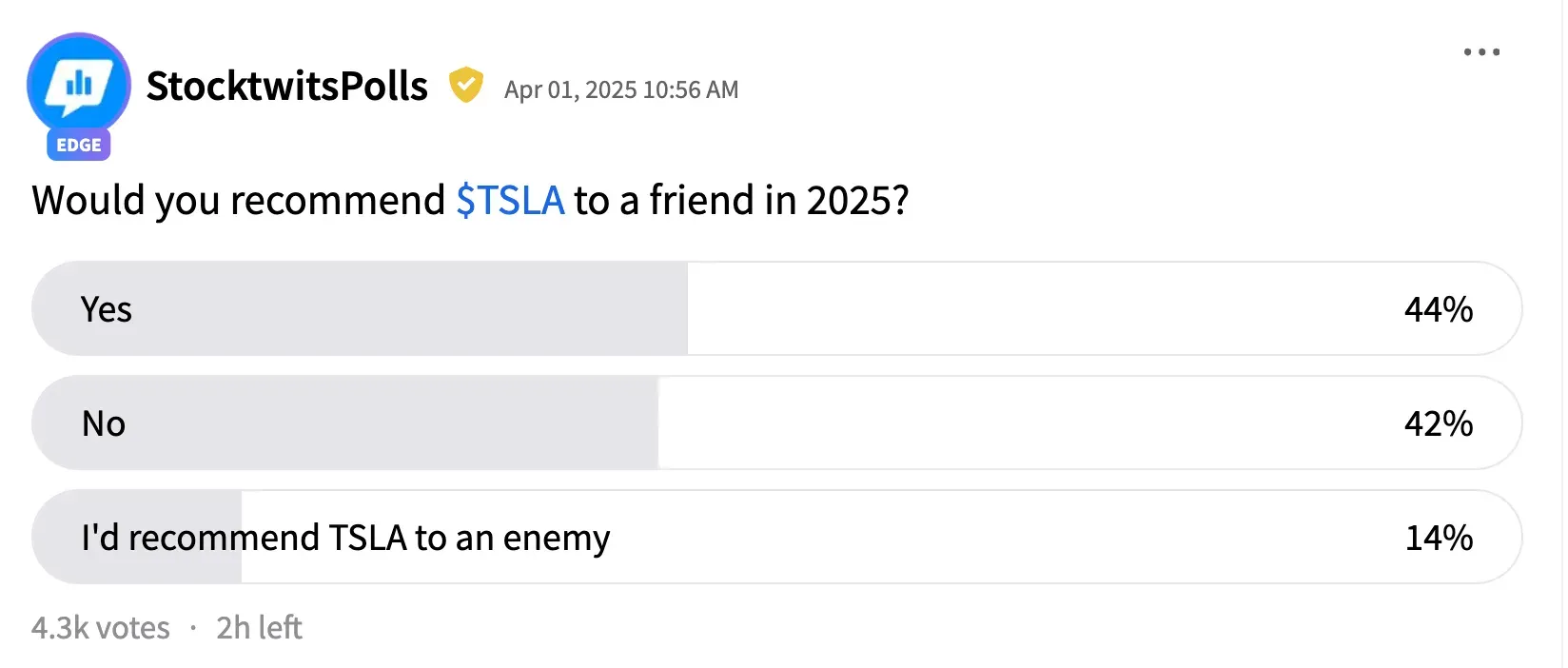

8. Tesla (TSLA): Interestingly, EV giant Tesla, with over a million followers on Stocktwits, drew a negative take from retail investors. According to the poll, 42% of the respondents say the stock is not worth recommending this year.

Notably, 14% even opined that they would recommend the stock to an enemy.

On Wednesday, Tesla missed first-quarter (Q1) delivery estimates, with the figure falling 13% year-over-year to 336,681. This marks the company’s worst quarterly performance in at least two years. According to consensus estimates compiled by FactSet, analysts expected Tesla to deliver 408,000 cars in the first three months of 2025.

9. Triller Group (ILLR): In February, the video-sharing social network company unveiled its 2025 roadmap. According to TheFly, Triller said that the Creator Economy is on its way to becoming a marketplace exceeding $500 billion. Powerful drivers are converging to create a once-in-a-lifetime opportunity, it said.

The company believes that market uncertainties are giving rise to new possibilities and that the Creator Economy is ripe for Triller's disruption and innovation.

The stock has lost over 74% in 2025 so far, and the pessimism is reflected in retail users’ opinions. A Stocktwits poll showed that the majority of the respondents held a negative take on the firm. Twenty-five percent of the respondents even went so far as to say they would recommend the shares to an enemy.

10. Trump Media & Technology Group Corp (DJT): The Truth Social parent, majority-owned by President Donald Trump, was in the spotlight recently after it had signed a non-binding agreement with crypto trading platform Crypto.com to launch a series of ETFs under the Truth.Fi brand.

However, DJT shares have lost over 43% since the beginning of the year, and retail investors appear to be increasingly anxious about the stock’s performance. Of the 1,000-odd respondents to a Stocktwits poll, 75% have a negative stance on the stock.

11. Mullen Automotive Inc. (MULN): Mullen shares have lost over 99% of their value in 2025. The company recently reported a record GAAP revenue of $3.18 million for its second quarter as of March 21, 2025. This quarterly revenue to date represents an 189% increase when compared to $1.1 million of GAAP revenue for all of 2024.

The significant erosion in the company’s market cap this year appears to have rattled retail investors. The latest Stocktwits poll shows that only 26% of the respondents consider the shares worth recommending to their friends. The remaining have a negative take on the stock.

12. Newsmax (NMAX): Shares of the Trump-endorsed news outlet surged over 2,600% over their initial public offering price by Tuesday. However, the stock had since pared a decent portion of these gains by Wednesday noon.

Despite the significant investor interest in the stock, retail investors on Stocktwits are not optimistic about its prospects. A Stocktwits poll showed that 62% of the respondents said they wouldn’t recommend the stock to a friend this year.

Twenty-one percent of respondents held an extremely negative bias toward the stock, while only 17% held an optimistic view on the shares.