Arista Networks stock has fallen nearly 10% since its earnings as Meta-related sales slowed, though its overall performance exceeded expectations.

Arista Networks (ANET) shares fell nearly 3% in morning trading Thursday, extending a post-earnings decline as investors reacted to slowing sales from Meta Platforms (META).

Despite the drop, retail traders remained bullish, with sentiment on Stocktwits suggesting many view the selloff as a buying opportunity.

The drop comes amidst bullish analyst calls and a surge in retail sentiment.

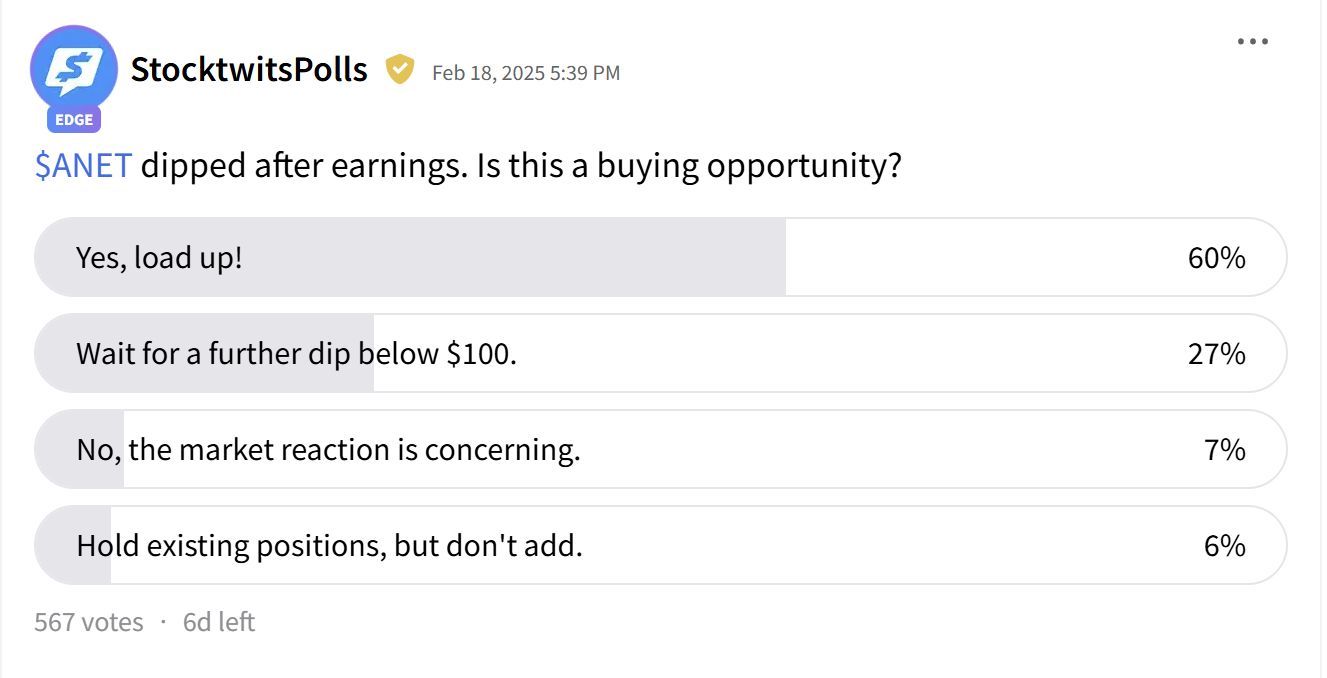

An ongoing Stocktwits poll shows that 60% of respondents believe the decline presents a strong entry point, compared to 27% waiting for an even lower price and 7% seeing the pullback as a warning sign.

Arista reported solid financial results, with revenue and earnings per share surpassing analyst expectations.

Although the numbers were solid, Morgan Stanley reported investors were concerned about a decline in sales from Meta Platforms (META), one of its largest customers.

Meta accounted for roughly 15% of Arista’s revenue, down from 20% a year ago.

The company’s earnings call revealed that despite Arista's overall sales growth and Meta spending a record amount on data center capital expenditures, Arista's Meta account shrunk by 17% year over year.

Morgan Stanley analysts noted that the drop follows a period of rapid expansion, with Arista’s Meta-related revenue surging 329% in 2022 and 8% in 2023. According to the brokerage, the decline aligns with the completion of Meta’s 400G upgrade in the second half of 2023.

“However, given concerns around share in Cloud Titans, it is something to continue to monitor,” Morgan Stanley said in its research note.

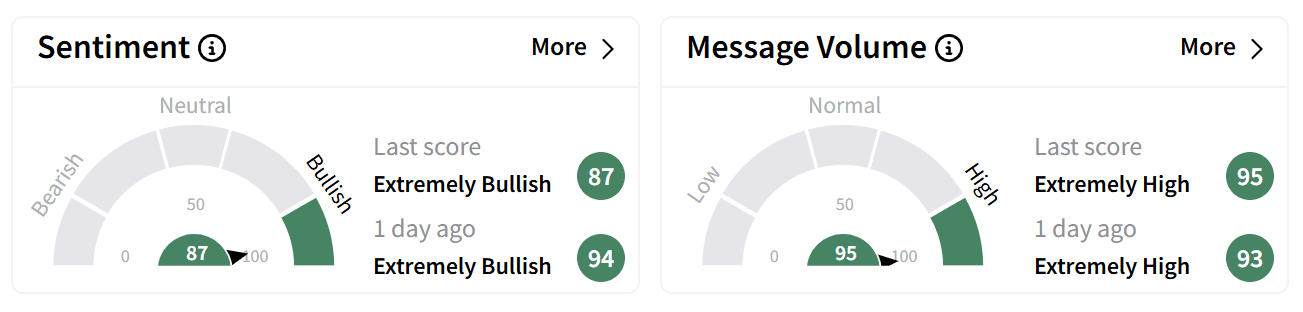

On Stocktwits, retail sentiment remained in the ‘extremely bullish’ zone accompanied by ‘extremely high’ levels of chatter.

Stocktwits user chatter shows retail believes Arista's dip is an overreaction rather than a fundamental shift in the company’s outlook.

Arista Networks’ stock has fallen nearly 10% since its earnings release but remains up by 55% for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: XRP Jumps As SEC Reviews ETF Filings, Brazil Approves First Spot ETF – Retail Sentiment Remains Bearish