Recent quarters’ performances show three straight revenue misses but bottom-line results exceeded expectations in these quarters.

Verizon Communications, Inc.’s (VZ) stock garnered bullish sentiment from retail investors on Stocktwits ahead of the telecom giant’s fiscal year 2024 fourth-quarter results, scheduled for 7 a.m. ET on Friday.

After ending 2024 up 13%, Verizon stock, the stock has lost about 0.3% in January. It ended Thursday's session up 0.59% at $39.18.

Consensus estimates call for Verizon to report fourth-quarter earnings per share (EPS) of $1.09 and revenue of $35.34 billion. This compares to the year-ago numbers of $1.08 and $35.1 billion, respectively.

Recent quarters’ performances show three straight revenue misses but bottom-line results exceeded expectations in these quarters.

In the preceding quarter, wireless service revenue rose 2.7% year-over-year (YoY) to $19.8 billion, or about 60% of the total revenue. Retail postpaid net additions for the wireless business were 349,000, and churn was 1.16%.

Analysts, on average, expect full-year adjusted earnings per share of $4.58 and revenue of $134.45 billion. In the third-quarter earnings report released in late October, Verizon guided non-GAAP EPS to $4.50-$4.70 and wireless service revenue growth to 2-3.5%.

Verizon derived roughly 79% of its fiscal year 2023 revenue from services and the remainder from equipment sales.

During the fourth quarter, Verizon and some of its peers were hit by cyberattacks organized by the China-linked Salt Typhoon cyberespionage group. The New York-based company also announced a collaboration with Nvidia for running artificial intelligence (AI) applications over its 5G private network with private Mobile Edge Compute.

In early August, Bernstein analysts initiated coverage of Verizon stock with a ‘Market Perform’ rating. The analysts highlighted the company’s postpaid net additions that lagged behind peers. However, they said things are moving in the right direction as the new management turns things around.

The Verizon management will host an earnings call at 8:30 a.m. ET.

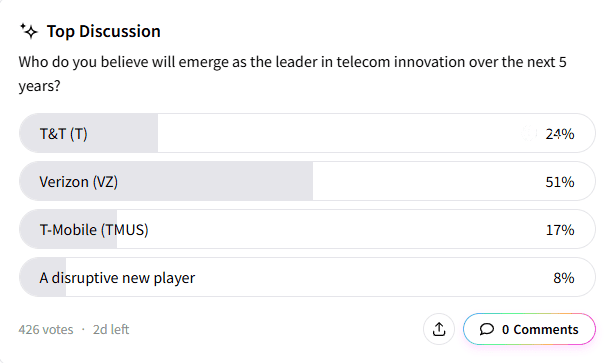

An ongoing Stocktwits poll found that a majority (51%) picked Verizon as the telecom company that will emerge as a leader in innovation over the next five years. Only half as much thought likewise about peer AT&T, Inc. (T).

Retail sentiment toward the stock stayed ‘bullish’ (73/100), with the degree of bullishness improving from a day ago. Message volume improved to ‘high’ levels.

Some Verizon stock watchers on the platform are gearing up for a good earnings report and a stock move above $40.

Another said they expect a blowout quarter, given several non-public catalysts are playing out behind the scenes.

A third suggested they would not be too worried about a potentially negative earnings report and instead focus on the dividend.

In early December, Verizon’s board declared a quarterly dividend of $0.68, payable on Feb. 3 to shareholders of record at the close of business on Jan. 10.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<