The project in Cameron Parish, Louisiana, has remained in the commissioning phase over the past three years due to the unreliability of its power generators.

Venture Global stock (VG) garnered retail attention on Tuesday after the company said it would begin commercial operations at its Calcasieu Pass liquefied natural gas facility on April 15.

The LNG project in Cameron Parish, Louisiana, has remained in the commissioning phase over the past three years due to the unreliability of its power generators.

Due to the delay, several customers, including Shell and BP, have launched arbitration proceedings against Venture Global.

On Monday, Venture Global said that it had notified its customers about the commencement date and would be able to fulfill its 20-year LNG supply contracts.

Earlier in February, TotalEnergies CEO Patrick Pouyanné told Reuters that the French company had rejected Venture Global as a supplier due to a lack of trust.

The Calcasieu Pass project's nameplate capacity is 10 million metric tons per annum (MTPA), but it could reach 12 million MTPA.

The announcement comes weeks after a Federal Energy Regulatory Commission report that said the company would complete repairs at the facility by the end of February.

In January, Venture Global raised $1.75 billion in its initial public offering and became the most valuable U.S. LNG firm.

Earlier in February, FERC had issued a draft supplemental environmental impact statement related to Venture Global’s proposed CP2 project. EIS is a crucial step towards the final permit.

Venture Global and its peers received a boost from President Donald Trump in January, who lifted a pause on new project approvals imposed by his predecessor, Joe Biden.

The U.S. emerged as the top LNG exporter after Russia invaded Ukraine, forcing countries to look for alternate suppliers of the commodity.

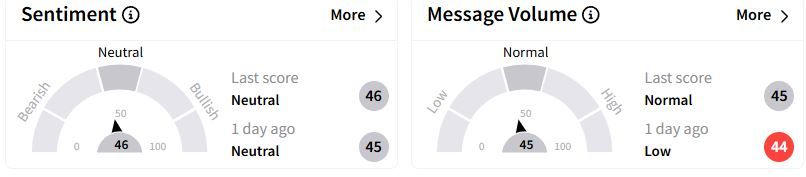

Retail sentiment on Stocktwits remained in the ‘neutral’ (46/100) territory, while retail chatter was ‘normal.’

Earlier this month, Bernstein analysts wrote that Venture Global is the "most audacious gas story" in their coverage, with the broadest range of possible outcomes, according to TheFly.

Venture Global stock has fallen about 36% since it was listed.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<