Consumer price index (CPI) rose 0.2% on a seasonally adjusted basis in April and increased 2.3% annually.

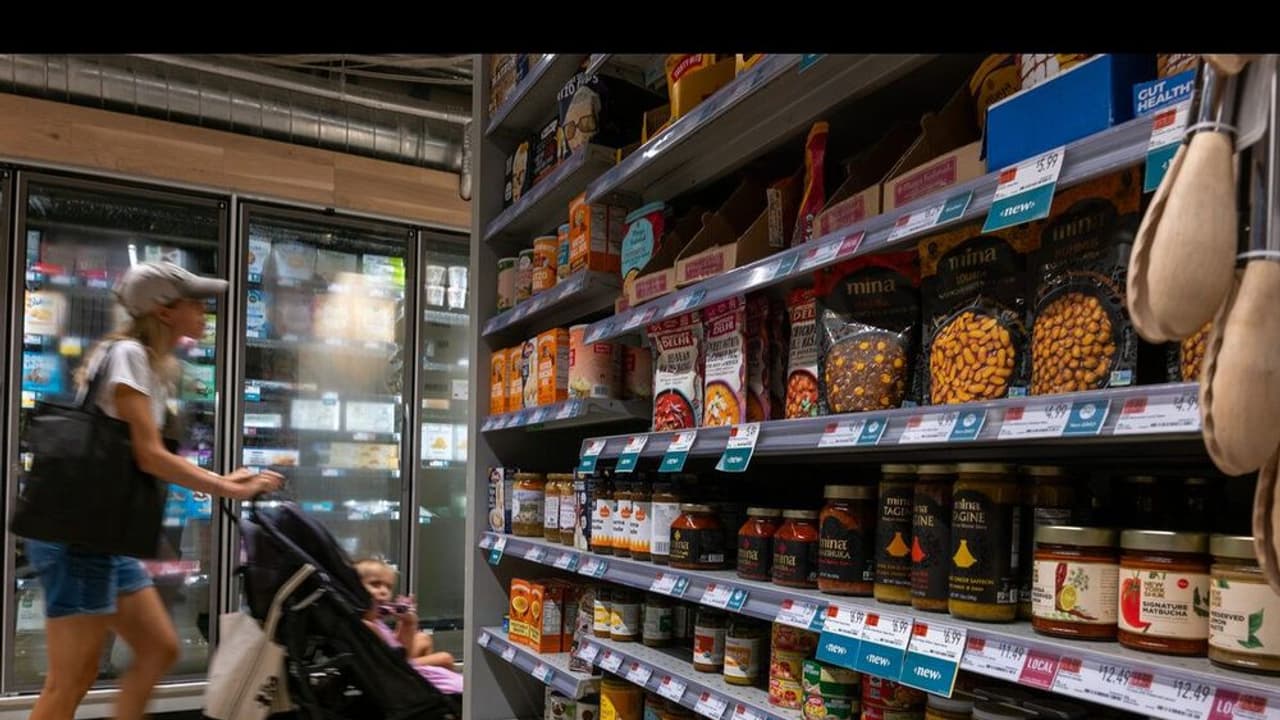

U.S. consumer prices rose less than expected in April as President Donald Trump's tariff policies started to affect the U.S. economy.

According to the Bureau of Labor Statistics (BLS), the consumer price index (CPI) rose 0.2% on a seasonally adjusted basis in April after declining 0.1% in March. On an annual basis, CPI increased 2.3% before the seasonal adjustment.

According to a CNBC report, the monthly figure aligned with a Dow Jones estimate, while the annual CPI came in below the estimated 2.4%.

Meanwhile, core CPI that excludes food and energy rose 0.2% in April, following a 0.1% increase in March. At the same time, core inflation rose 2.8% for the 12 months ending April. According to the report, economists estimated the figures to be 0.3% and 2.8%, respectively.

In April, the index for shelter rose 0.3%, accounting for over half of the monthly increase in all items. At the same time, the energy index rose 0.7% as increases in the natural gas index and the electricity index more than offset a decline in the gasoline index.

Meanwhile, the index for food decreased 0.1% in April, after rising 0.4% in March. The BLS pointed out that the index for meats, poultry, fish, and eggs fell 1.6% in April after rising in recent months, driven primarily by a 12.7% decrease in the index for eggs.

According to the latest data on the CME FedWatch Tool, traders have factored in a 50 basis point cumulative rate reduction this year. At one point over the last two months, traders expected the Federal Reserve to cut rates by 100 basis points in 2025.

Following the release of the CPI data, the yield on the two-year treasuries fell three basis points on Tuesday morning, while the 10-year yield fell marginally. The iShares 7-10 Year Treasury Bond ETF (IEF) traded 0.15% higher in the pre-market session.

Benchmark indices also traded marginally in the green. The SPDR S&P 500 ETF Trust (SPY), which tracks the S&P 500, traded 0.02% higher, while the Invesco QQQ Trust, Series 1 (QQQ), which tracks the Nasdaq Composite, gained 0.25%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<