The healthcare firm is facing renewed scrutiny over its earnings practices and competitive pressures in the pharmacy benefits sector, deepening investor concerns.

UnitedHealth Group (UNH) shares remained under pressure Tuesday, trending in the top 10 on Stocktwits amid a series of negative headlines that have deepened investor unease about the company's financial strategy and outlook.

At the close on Tuesday, shares of UNH fell 2.9% to $291.71, with an additional 0.2% drop to $291.1 in after-hours trading.

UNH discreetly sold stakes in several business units to private equity firms, including Warburg Pincus and KKR, near the end of 2024, Bloomberg reported.

The transactions, which generated $3.3 billion in gains, were booked as part of operating income and adjusted earnings, metrics investors typically use to assess core performance.

At the same time, the company excluded a $7.1 billion loss from its exit in Brazil from those measures.

The structure and timing of the deals, along with confidentiality clauses and buyback provisions that could force UnitedHealth to repurchase the stakes at higher prices, led institutional investors and analysts to believe the transactions were designed to help the company maintain its streak of beating Wall Street earnings expectations — a streak that had lasted more than 60 quarters.

Without the gains, analysts said UnitedHealth would have missed estimates for the first time since 2008.

Critics, including Gabelli Funds’ Jeff Jonas, questioned the inclusion of the gains in adjusted figures.

“When you include that gain, you’re really including the equivalent of multiple years of earnings in one year,” he told Bloomberg. John Ransom, an analyst at Raymond James, referred to the earnings as “low-quality and non-recurring in nature.”

Compounding concerns, Morgan Stanley lowered its price target on UNH to $342 from $374, warning that new leadership may set conservative guidance for 2025 and 2026 due to continued Optum challenges and rising costs.

Leerink Partners also trimmed its target to $340 from $355, citing fading investor expectations ahead of the company’s updated 2025 forecast, according to an Investing report.

In another adverse development, the California Public Employees’ Retirement System (Calpers) awarded a five-year pharmacy benefits contract to CVS Health’s (CVS) Caremark unit, replacing UnitedHealth’s OptumRx.

The contract covers outpatient drug benefits for 587,000 Calpers members, which makes about 40% of its healthcare beneficiaries, the Wall Street Journal reported.

CVS was selected based on affordability, quality, and transparency, and has committed to putting $250 million at risk, if cost and quality goals aren’t met.

UnitedHealth, valued at $273 billion, is also navigating fallout from the abrupt resignation of CEO Andrew Witty in May and the ongoing scrutiny of its Medicare billing practices.

On Stocktwits, retail sentiment for UNH was ‘extremely bullish’ amid ‘high’ message volume. It was also among the top 15 active tickers on the platform.

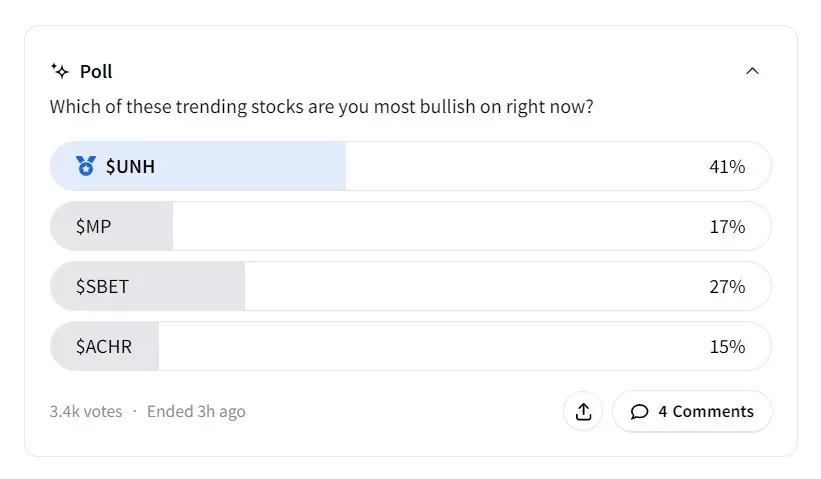

A Stocktwits poll that sought responses from users regarding which trending stocks they were “most bullish” found that most (41%) were positive about UnitedHealth.

UNH’s stock has declined 42.2% so far in 2025.

See also: Fed’s Logan Says Monetary Policy Needs To ‘Hold Tight’ For A While Longer Even As Trump Steps Up Call For 3-Point Rate Cut

For updates and corrections, email newsroom[at]stocktwits[dot]com.<