UMC is betting on capacity expansion and innovation to drive its growth in the future, including catering to the demand for artificial intelligence-optimized chips.

Shares of United Microelectronics Corp. (UMC) declined nearly 5% in morning trade on Tuesday, tumbling to a two-year low after the company posted mixed fourth-quarter results.

UMC reported revenue of $1.84 billion in the fourth quarter, rising 9.9% year-on-year. Its net income stood at $259 million, declining from $402 million a year ago.

UMC’s earnings per American Depository Share (ADS) also fell during the fourth quarter to $0.104 from $0.162 a year ago.

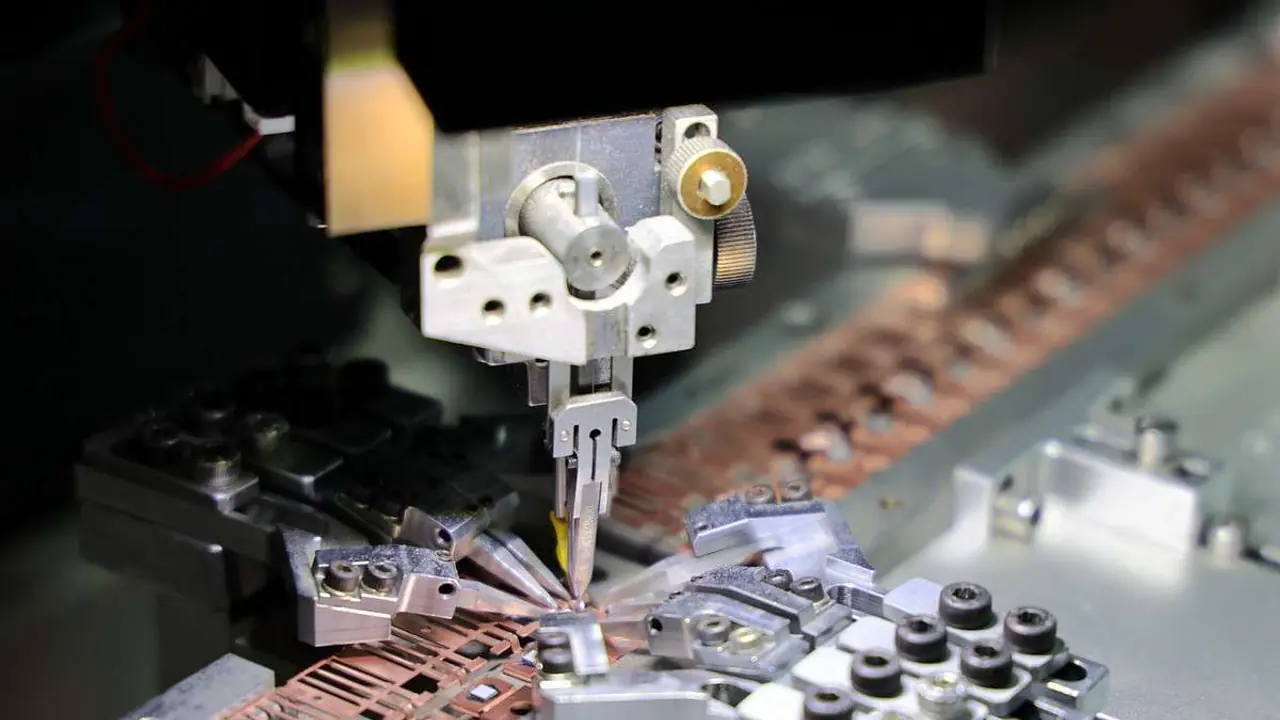

The company is betting on capacity expansion and innovation to drive its growth in the future, including catering to the demand for artificial intelligence-optimized chips.

“Our new Singapore Phase 3 fab will enhance customers’ supply chain resilience, while the 12nm collaboration with our U.S. partner will offer customers a migration path beyond 22nm,” said Jason Wang, co-president of UMC.

UMC and Intel Corp. (INTC) announced partnership in January 2024 to develop a 12-nanometer semiconductor process, aimed for use in mobiles, communication infrastructure, and networking.

Retail sentiment on Stocktwits was upbeat despite the mixed results, entering the ‘extremely bullish’ (86/100) territory from ‘neutral’ (46/100) a day ago. Message volume also rose significantly to enter the ‘extremely high’ (85/100) zone.

Investors sounded a positive note for the UMC stock, with one user saying it is a bigger deal than Intel.

Tuesday’s dip notwithstanding, one user has a price target of $9 for the UMC stock.

UMC's share price has been on the decline of late – it has fallen nearly 25% over the past six months, while its one-year performance is worse with a decline of nearly 27%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<