A Bloomberg report said the current round impacts higher management levels and lower ranks.

UBS shares garnered retail attention on Monday after a Bloomberg report, citing people familiar with the matter, said the company is cutting hundreds of jobs in Switzerland.

The report said the current round impacts higher management levels and lower ranks.

“We will keep the number of jobs cuts in Switzerland and globally as a result of the integration as low as possible,” a UBS spokesperson told Stocktwits in an emailed response.

UBS had planned to lay off 3,000 employees in its bid to integrate the troubled lender Credit Suisse, which it acquired in 2023 following a government intervention.

“The role reductions will take place over the course of several years and will be mostly achieved through natural attrition, early retirement, internal mobility, and in-housing of external roles,” the spokesperson added.

The company had about 36,000 employees in Switzerland as of Dec. 31, 2023.

The UBS spokesperson also said that the bank is helping the affected employees to find a new job within UBS or externally.

Last week, UBS CEO Sergio Ermotti had flagged further headcount reductions in an interview with Bloomberg.

Ermotti said that the largest Swiss bank aimed to reduce costs by another $5.5 billion in addition to the $7.5 billion already achieved since the Credit Suisse deal.

U.S.-listed shares of UBS rose marginally in afternoon trade.

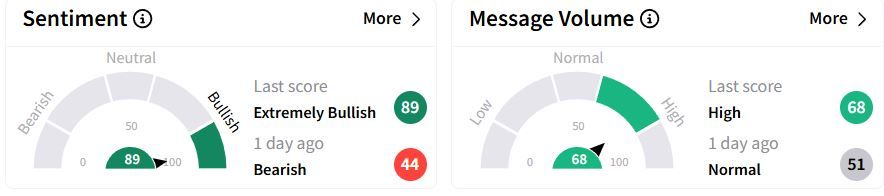

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ (89/100) territory from ‘bearish’(44/100) a day ago, while retail chatter was ‘high.’

Over the past year, the stock has gained 19.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<