Over the past week, Uber has inked several agreements to ramp up its robotaxi operations amid heightened competition from companies like Tesla and Alphabet’s Waymo.

Uber Inc. (UBER) stock is expected to draw retail attention on Monday after Morgan Stanley raised the price for the stock to $115 from $95 and maintained an ‘Overweight’ rating.

The new price target implied a 27% upside compared to the stock’s previous closing price. According to Fiscal.ai data, the ride-hailing company’s stock has a consensus price target of $99.01.

According to TheFly, Morgan Stanley raised the price target for Uber as part of its re-evaluation of stocks in the internet space due to an improvement in the macroeconomic backdrop and the removal of China tariffs.

U.S. markets have rebounded from a sharp drop in April after concerns surrounding President Donald Trump’s tariffs eased slightly following the U.S. agreement on trade deals with the UK, Indonesia, and Vietnam.

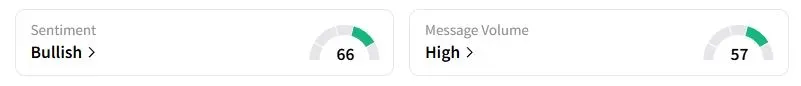

Retail sentiment about Uber was in the ‘bullish’ territory at the time of writing, while retail chatter was ‘high.’

Uber stock has seen a 75% spike in retail chatter over the past week, following the signing of several agreements to ramp up its robotaxi operations amid heightened competition from companies like Tesla and Alphabet’s Waymo.

It signed an agreement with electric vehicle maker Lucid to add 20,000 vehicles on the Uber platform as robotaxis. The cars will be equipped with Nuro, Inc.’s Level 4 autonomy system, called Nuro Driver, and are expected to launch later next year in a major U.S. city.

Separately, Uber announced a multi-year strategic partnership to deploy thousands of Baidu’s Apollo Go autonomous vehicles on the Uber platform across multiple markets outside the U.S. and mainland China.

Uber stock has gained nearly 46% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<