The FTC alleged in a lawsuit that the ride-hailing firm charged consumers for its Uber One subscription service without their consent.

Uber (UBER) stock fell 3.1% on Monday after the U.S. Federal Trade Commission sued the company over “deceptive billing and cancellation practices” at its Uber One subscription program.

The FTC alleged in a lawsuit that the ride-hailing firm charged consumers for its Uber One subscription service without their consent, did not deliver promised savings, and made it difficult for users to cancel the service despite its “cancel anytime” promises.

“Americans are tired of getting signed up for unwanted subscriptions that seem impossible to cancel,” FTC Chairman Andrew Ferguson said.

The FTC alleged in the lawsuit at a California district court that, after sign-up, Uber charges consumers even before their billing date.

Some consumers who signed up for a free trial were allegedly charged for the service automatically before the trial ended.

The consumer protection agency also said that many consumers were enrolled without their consent, and the company made it extremely difficult to cancel subscriptions.

“Users can be forced to navigate as many as 23 screens and take as many as 32 actions to cancel,” the FTC said.

“We are disappointed that the FTC chose to move forward with this action, but are confident that the courts will agree with what we already know: Uber One’s sign-up and cancellation processes are clear, simple, and follow the letter and spirit of the law,” Uber reportedly said in a statement.

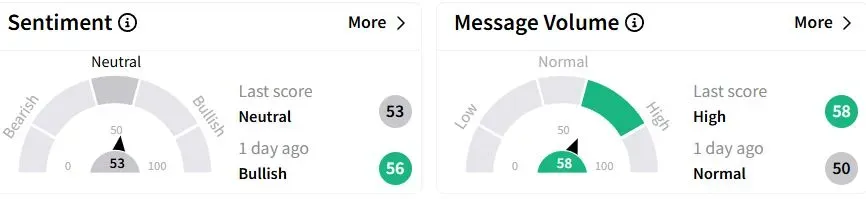

Retail sentiment on Stocktwits moved to ‘neutral’ (53/100) territory from ‘bullish’(56/100) a day ago, while retail chatter was ‘high.’

One retail trader suggested that every company does what Uber allegedly did, and most FTC lawsuits get dropped.

The company is scheduled to report its first-quarter results on May 7.

Uber shares have gained 17.3% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<