Cannacord believes that while Uber and Lyft’s future in autonomous vehicles “could be bright,” there’s also an alternative scenario where they could be left “reflecting on the golden days of the past.”

Investment bank Canaccord last night downgraded Lyft Inc. (LYFT) and Uber Technologies Inc. (UBER), citing uncertainty over the potential of autonomous vehicles to dominate the market.

Canaccord downgraded Lyft to ‘Hold’ from ‘Buy’ with a price target of $14, down from $22 .It also downgraded Uber to ‘Hold’ with a price target of $84, down from $90.

Lyft’s stock was trading 2% lower on Friday morning, while Uber’s stock edged 1% lower.

Canaccord’s new price target on Lyft represents a near 12% downside to the stock’s closing price on Thursday and the new price target on Uber represents a 10% downside to the stock’s closing price of $93.12 in the last trading session.

The future of Uber and Lyft "could be bright," providing value-added services in the autonomous vehicle world through hybrid human-robot networks, strong on-the-ground operations, and other tactical elements, the analyst told investors in a research note, as per TheFly.

However, an alternative scenario is also plausible, where a world dominated by a few autonomous vehicle "behemoths" controls the value chain and leaves Uber and Lyft "reflecting on the golden days of the past," contends Canaccord.

The firm believes the outcome "is truly unclear." It does expect continued growth "for now," saying both companies have strong service platforms and continue to grow ride-share.

However, it sees uncertainty and potential for "rapid disruption" as the autonomous vehicle market crystallizes.

The robotaxi market in the U.S. is currently dominated by Alphabet Inc. (GOOG, GOOGL) unit Waymo. Waymo currently operates over 1,500 robotaxis in San Francisco, Los Angeles, Phoenix, and Austin and provides more than 250,000 paid trips each week.

Earlier this week, EV giant Tesla Inc. (TSLA) also pilot-launched its robotaxi service in a geofenced area within Austin. While the launch was small, Tesla CEO Elon Musk has previously said that the company will add more vehicles and cities to the service over time.

Other players in the segment include Zoox, the autonomous vehicle company owned by Amazon.com (AMZN).

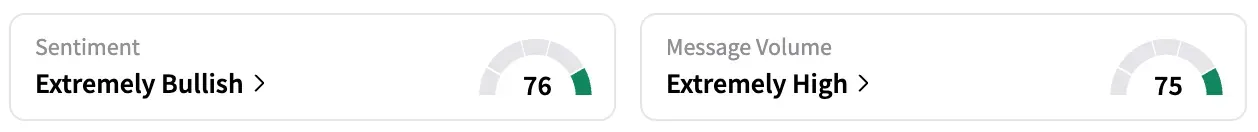

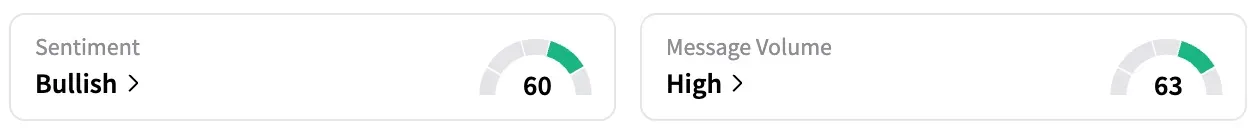

On Stocktwits, retail sentiment around Uber jumped from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours, while sentiment around Lyft stayed unchanged within the bullish territory.

While Uber’s stock is up by 52% this year, Lyft is up by about 19%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<