XOMA Royalty will acquire Turnstone for $0.34 in cash per share of Turnstone common stock plus one non-transferable contingent value right.

Shares of Turnstone Biologics Corp. (TSBX) jumped over 5% on Friday morning after the company said that it has entered into a definitive merger agreement whereby XOMA Royalty Corporation (XOMA) will acquire Turnstone.

As per the agreement, XOMA Royalty will acquire Turnstone for $0.34 in cash per share of Turnstone common stock plus one non-transferable contingent value right.

The upfront payment of $0.34 represents a 2.4% upside to the stock’s closing price on Thursday.

Turnstone Biologics is a biotechnology company developing new medicines to treat and cure patients with solid tumors. Its Board of Directors has unanimously determined that the acquisition by XOMA Royalty is in the best interests of all Turnstone stockholders and has approved the merger agreement and related transactions, the company said.

The merger transaction is expected to close in August 2025.

XOMA Royalty, meanwhile, is a biotechnology royalty aggregator – a company that acquires the rights to future royalties and milestone payments from biopharmaceutical companies – with over 120 assets. Royalty aggregators typically provide a form of non-dilutive financing for biotech companies, allowing them to access capital without selling equity or taking on debt.

Turnstone had cash, cash equivalents, and short-term investments of only $21.9 million as of the end of the first quarter (Q1). The company’s net loss in the three months through the end of March this year was $11.8 million, compared to a net loss of $19.6 million for the same period in 2024.

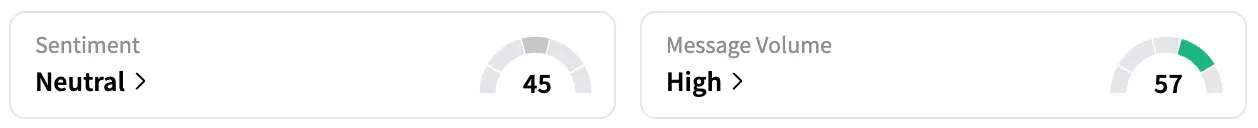

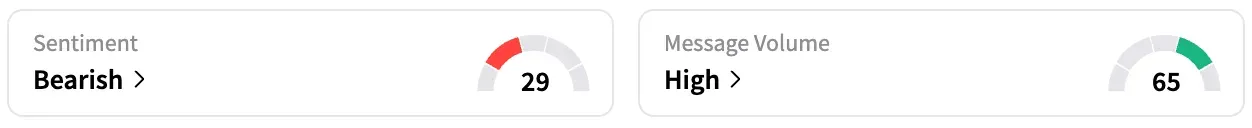

On Stocktwits, retail sentiment around XOMA jumped from ‘bearish’ to ‘neutral’ territory over the past 24 hours while sentiment around TSBX slumped from ‘neutral’ to ‘bearish’.

While XOMA is up by 5% this year, TSBX is down by about 30%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<