Under the deal terms, the aerospace and defense firm’s shareholders would receive $26 per share in cash.

Triumph Group Inc. (TGI) shares jumped 34% in premarket trade on Monday after the company agreed to be taken private by the affiliates of Warburg Pincus and Berkshire Partners in a $3 billion deal.

Under the deal terms, the aerospace and defense firm’s shareholders would receive $26 per share in cash. The purchase price implies a 38.7% upside to the stock’s closing price on Friday.

The private equity firms would jointly control Triumph through a new entity following the deal's closing, expected in the second half of 2025.

"With our deep experience investing in and developing aerospace platforms, we look forward to working with Triumph’s talented global team to increase opportunities for its portfolio and capture the growing demand for high-quality aerospace components," said Warburg Pincus Managing Director Dan Zamlong.

The PE firms had previously joined hands in 2019 to buy another aerospace and defense company, Consolidated Precision Products, for an undisclosed amount.

Triumph and its peers have benefited from a rise in servicing revenue, as delays in new aircraft deliveries have forced operators to boost their spending on maintaining existing aircraft.

It had reiterated its fiscal 2025 net sales expectations of about $1.2 billion in November.

Last year, the company sold its product support business to AAR Corp for $725 million to lower its debt.

Goldman Sachs & Co. LLC served as Triumph's exclusive financial advisor, and Lazard advised Berkshire Partners and Warburg Pincus.

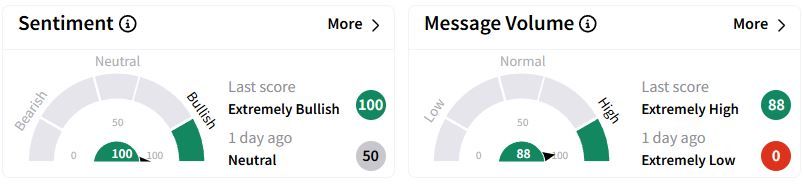

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (100/100) territory from ‘neutral’(50/100) a day ago, while retail chatter soared to ‘extremely high.’

One user on Stocktwits expressed disappointment after selling the entire position in the Triumph stock last week.

Over the past year, Triumph stock has gained 19.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<