Gold is surging, breaking records almost weekly as it grinds towards $3,500 per ounce.

Central banks are stacking.

Governments are inflating.

And investors everywhere are scrambling to catch the next breakout in the gold sector.

But one name has somehow stayed under the radar…

Source: Mineros SA

Mineros SA (MSA)

Here at The Net Worth Club, we dig for value the same way the miners dig for ounces — systematically, obsessively, and with a nose for what the market is missing.

And right now, it’s missing Mineros SA (TSX: MSA).

Source: Mineros SA

Let’s Talk Numbers

In 2024, Mineros produced 213,000 ounces of gold at an average AISC (All-In Sustaining Cost) of just $1,551 per ounce, while selling its gold at an average realized price of $2,387.

That’s serious margin.

In fact, it translated into US$86 million of free cash flow, a 76% year-over-year jump.

And that was before gold blasted past $3,000.

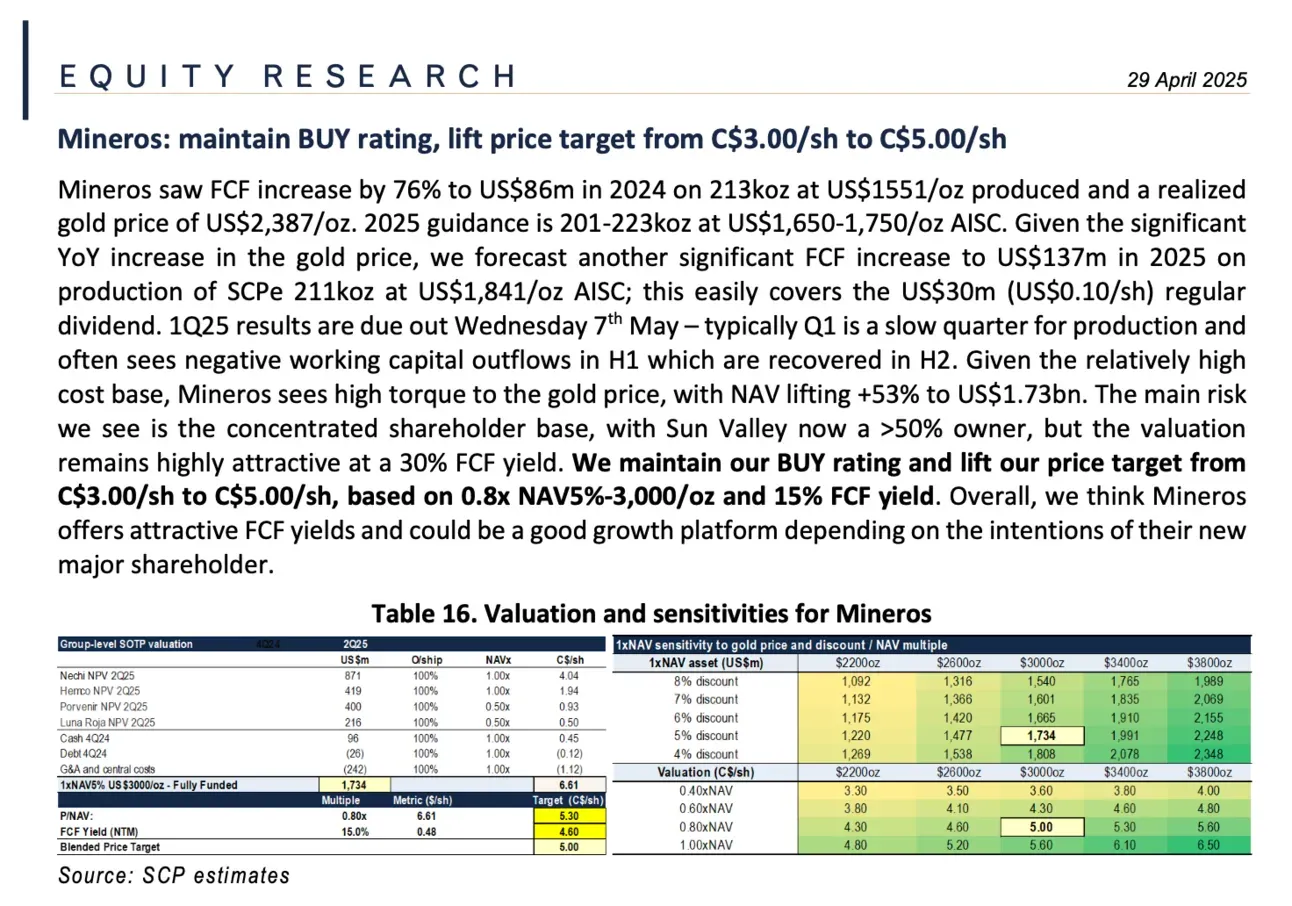

SCP Research now estimates 2025 free cash flow will hit US$137 million, based on production of ~211,000 ounces at an AISC of $1,841.

That’s a 30% free cash flow yield at today’s price. It’s so juicy it almost doesn’t sound real.

Source: SCP Research

Oh, and they pay a $0.10 annual dividend, fully covered by earnings, with significant room to grow.

To put that in context: while most juniors are raising capital just to survive, Mineros is spitting off enough cash to fund exploration, pay dividends, and weather any volatility in the gold price.

That level of resilience is rare.

Especially in a small-cap stock.

Undervalued by Any Metric

Mineros is now trading at just 0.25x NAV.

That’s one of the steepest discounts in the entire gold sector.

SCP has increased its NAV estimate by 53% to US$1.73 billion, and boosted its price target to C$5.00 per share, up from C$3.00.

Let me put that into perspective.

The stock is trading at C$2.30, and it’s fully funded, profitable, producing 200,000+ ounces a year, and yielding 30% FCF.

If this isn’t a re-rate waiting to happen, I don’t know what is.

Mineros SA (TSX: MSA) one-year stock chart. (Source: stockwatch.com)

Compare that to other names in the sector…

Many developers with no production and negative cash flow trade at 0.6–0.8x NAV.

Mineros, by contrast, is cash generative today and still trades at a deep discount.

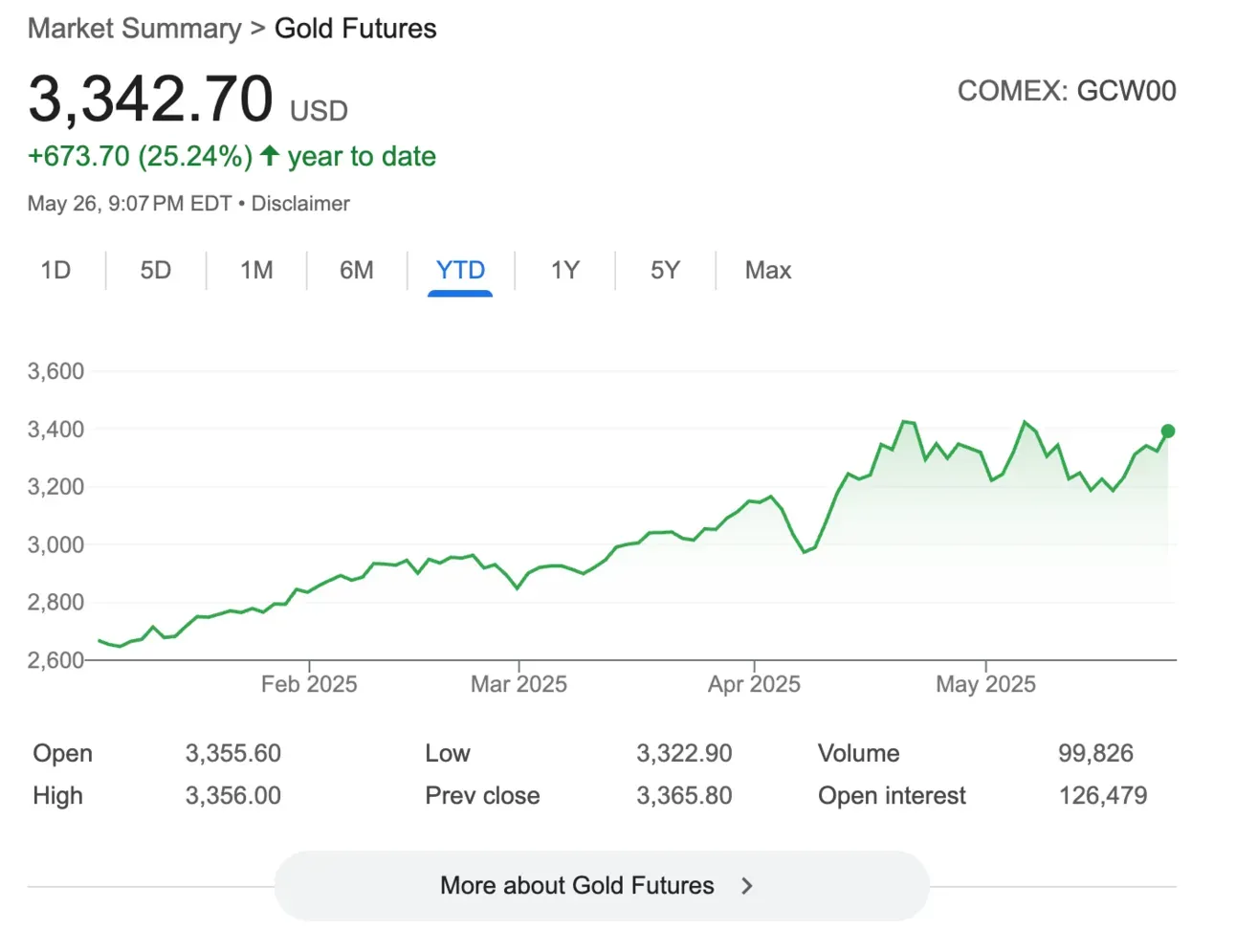

The Gold Macro Tailwind

This valuation gap exists at a time when gold is breaking out, driven by a perfect storm:

- Central bank accumulation hitting multi-decade highs

- Geopolitical risk, inflation uncertainty, and fiat debasement

- U.S. debt-to-GDP ratios north of 120%

- A global move toward de-dollarization

Gold Futures YTD chart. (Source: Google Finance)

Every one of these macro factors feeds directly into the gold narrative.

And if you’re buying gold miners today, you want leverage to that thesis.

Mineros offers that in flying colours.

Their cost base is relatively high compared to ultra-low-cost producers, but that’s exactly the point.

High-cost producers benefit more from rising gold prices.

Every extra $100 in the gold price drops straight to the bottom line.

That’s why Mineros has such strong leverage to the upside.

A Platform for Growth… Or an Acquisition Target?

One thing to note: Mineros’ shareholder base is dominated by Sun Valley Investments, who now own over 50% of the company. In fact, as of yesterday’s announcement and assuming the transaction closes, as I’m confident it will, their stake will rise to nearly 65%, representing approximately C$480 million.

Source: Sun Valley Investments AG

That might scare off some investors looking for big float and liquidity. (Although Mineros has both)

But from my perspective, and I am biased as I am pals with Vik Sodhi (Managing Partner & Co-Founder of Sun Valley), but to me, it means just one thing: strategic action is coming.

Sun Valley Investments AG press release screenshot. (Source: Business Wire)

Whether Mineros becomes a consolidator, rolling up assets in Latin America, or gets taken out by a mid-tier hungry for cash flow and production growth, something will give.

And shareholders will likely win either way.

Imagine a suitor who wants to add 200,000 ounces of steady production to their portfolio, without having to build a mine from scratch.

Mineros becomes a compelling bolt-on.

Or picture Mineros deploying its cash flow into opportunistic M&A.

With the gold bull market heating up and developers struggling for capital, there are assets ripe for the taking.

Catalysts on Deck

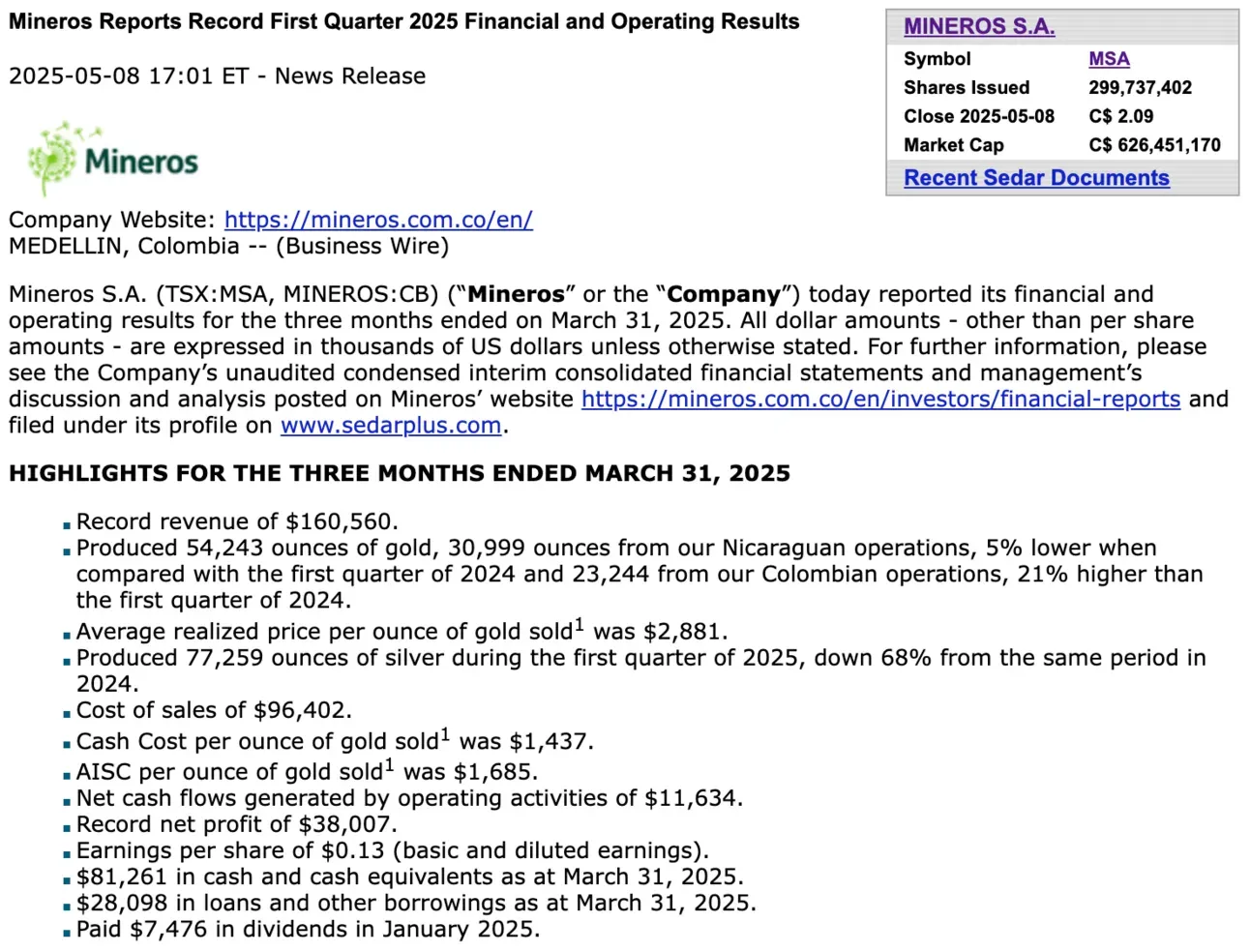

Mineros reported Q1 2025 earnings on May 8.

This quarter is often slower due to working capital outflows, but they knocked it out of the park with dramatically expanded margins. And they report in $USD.

Mineros SA Q1 2025 earnings press release screenshot. (Source: Mineros SA)

Beyond that, we’ll be watching for:

- Updated mine life projections from core assets in Colombia, Nicaragua, and Argentina

- Any M&A activity or signals of expansion into new jurisdictions

- Revised dividend guidance if free cash flow continues its upward march

- Exploration results that could bolster future reserves

The Bigger Picture

Let’s zoom out for a moment.

Gold is no longer just a hedge.

It’s becoming a core allocation for sovereigns, institutions, and family offices.

The long-term price forecast from leading analysts now sits at $3,000 per ounce, with upside to +$5,000 or higher if macro instability persists.

Even Goldman is saying north of $3,800.

Why gold prices are forecast to rise to new record highs

Gold prices are climbing amid renewed appetite from investors and a long-term structural shift in demand for the metal from central banks.

www.goldmansachs.com/insights/articles/why-gold-prices-are-forecast-to-rise-to-new-record-highs

In that environment, quality producers with cash flow and leverage to the gold price become strategic assets.

And Mineros? It’s sitting right in the sweet spot.

Bottom Line

When we look for doubles or even triples at The Net Worth Club, we want real assets, real cash flow, and real catalysts.

Mineros checks every box.

Mineros x Sun Valley. (Source: 360 Radio)

It’s not some drill-play with 10 holes and a dream.

This is a full-cycle, cash-flowing producer with leverage to a historic gold bull market.

And it’s trading at a massive discount.

We think Mineros could double if not triple — and even that might be conservative.

I’m not long yet, but I’m seriously considering it.

And I think smart money will be, too, and soon.

Sun Valley is already in, are you?

As always, do your own due diligence, and Happy Hunting!

Subscribe for research like this!