BofA’s new price target implies a 3.4% upside to Tesla’s closing price on Friday.

Bank of America on Monday raised its price target on Tesla Inc. (TSLA) to $341 from $305 ahead of the EV maker’s second-quarter earnings.

The new price target implies a 3.4% upside to Tesla’s closing price on Friday. BofA kept a ‘Neutral’ rating on the shares.

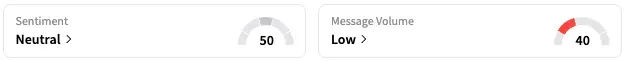

On Stocktwits, retail sentiment around Tesla jumped from ‘bearish’ to ‘neutral’ territory over the past 24 hours, while message volume stayed at ‘low’ levels. Tesla stock traded 0.3% lower at the time of writing and is among the top 10 most active stocks on the Stocktwits platform.

According to Stocktwits data, message volume around Tesla surged 114% over the past 24 hours as investors get ready for the second-quarter earnings.

Tesla Q2 earnings are likely to be challenged due to tariffs and "disappointing deliveries," noted the analyst, as per TheFly, who revised the firm's estimates to account for Tesla reporting deliveries 11.8% below BofA's initial estimate.

Tesla reported deliveries of 384,122 units in Q2, marking a 13.5% year-over-year decline and the second consecutive quarter of declining deliveries.

On "a more positive note," Tesla did start its Robotaxi service in Austin, which gives the firm more confidence in the promise to deliver unsupervised FSD by the end of 2025, the analyst added in a preview.

Tesla is scheduled to report its second-quarter earnings after the closing bell on Wednesday. Analysts on average expect the company to report an earnings per share of $0.4, below the $0.52 reported in the corresponding quarter of 2024.

Revenue for the three months through the end of June is expected to be $22.27 billion, down from the $25.5 billion reported for the corresponding period of 2024.

According to a poll on Stocktwits posted earlier on Monday, which garnered 920 votes at the time of writing, 52% of voters are most excited about Tesla's earnings this week compared to those of Alphabet Inc., ServiceNow, and IBM.

A Stocktwits user opined that the company’s earnings would have been “a lot better” had it not sold its bitcoin holdings.

Another expressed optimism that the stock would return to over its $400 threshold after the earnings.

Tesla stock is down 19% this year and up about 31% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<