With weak technical indicators across daily and weekly charts, Tata Motors may test key support levels near ₹580, according to the analyst.

Tata Motors shares remain under pressure on Tuesday, extending their losses after its British unit, Jaguar Land Rover (JLR), issued a subdued outlook for the current financial year.

On Monday, JLR said that it expects its EBIT margin to be between 5% and 7% for FY26, compared to the 8.5% margin it reported in the previous financial year.

Tata Motors stock has fallen nearly 6% in the last five sessions.

From a technical perspective, SEBI-registered analyst Sameer Pande highlighted that Tata Motors is showing negative momentum on the monthly timeframe. Its Relative Strength Index (RSI) is near 46, and the stock trades below the Supertrend and VWAP levels.

Pande sees support around ₹600, with resistance around ₹850-900 levels.

On a weekly timeframe, the stock appears to be moving sideways to negative territory, with an RSI around 44 and super trend resistance around ₹743-745. Pande pegs support levels at around ₹580.

On a daily timeframe, he believes that a fresh breakout below the supertrend level indicates further weakness, with the RSI below 40. Pande recommends keeping the stop loss at ₹740 on a closing basis.

He has set a target of ₹580 for Tata Motors to be achieved by the end of July.

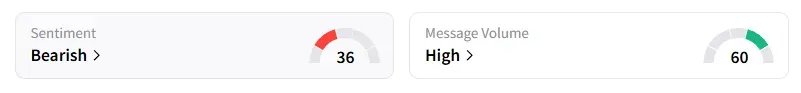

Data on Stocktwits shows retail sentiment has been ‘bearish’ for a month on this counter.

Tata Motors stock has fallen nearly 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<