Apple could reportedly receive the first batch of mass-produced chips from Taiwan Semiconductor’s Arizona facility by the end of the March quarter.

Shares of Taiwan Semiconductor (TSM) experienced volatility in morning trade on Tuesday after reports emerged that the chipmaker is inching closer to approval from one of its key customers, Apple Inc. (AAPL), for chips produced at its Arizona plant.

Apple is in the final stages of approving TSM’s made-in-America chipsets, according to a report by Nikkei Asia. This is a crucial development for the iPhone-maker as it has been looking to diversify its supply chain after the post-COVID shocks.

The report notes that Apple could receive the first batch of mass-produced chips from Taiwan Semiconductor’s Arizona facility as soon as the March quarter.

Taiwan Semiconductor has also reportedly received approval from the Taiwanese government to set up production facilities in the U.S. to manufacture 2-nanometer chips in the country.

According to a report by Taiwanese publication UDN, the government has left it to the discretion of semiconductor companies to decide if they should manufacture 2nm or other advanced chips in foreign countries.

This is a shift from previous policies that required Taiwanese chipmakers to keep their domestic production technology ahead by a generation or two compared to foreign facilities.

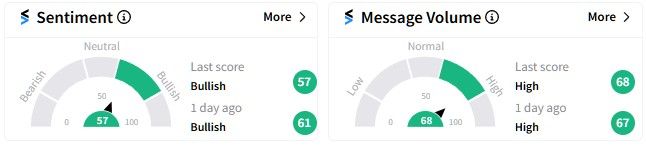

Retail sentiment on Stocktwits remained in the ‘bullish’ (57/100) territory, while message volume was also in the ‘high’ (68/100) zone at the time of writing.

Users expressed optimism, with one saying the stock could surge after the company’s detailed earnings report later this week.

However, some expressed concerns about President-elect Donald Trump reversing course on the Biden administration’s CHIPS Act funding to Taiwan Semiconductor and other chipmakers. TSM was awarded $6.6 billion to set up a chip fabrication facility in Phoenix, Arizona.

TSM stock price has edged up by nearly 8% over the past six months, but its one-year return is stellar, with gains of over 96%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.