Summit now intends to file a Biologics License Application (BLA) with the U.S. Food and Drug Administration seeking approval for Ivonescimab plus chemotherapy based on the results of the trial.

Summit Therapeutics Inc. (SMMT) lost more than a quarter of its market capitalization on Friday morning after the oncology company said that its global late-stage study evaluating Ivonescimab met the progression-free survival (PFS) primary endpoint but failed to achieve a statistically significant benefit in overall survival.

In the late-stage study evaluating Ivonescimab plus platinum-doublet chemotherapy compared to placebo plus platinum-doublet chemotherapy in patients with a type of lung cancer, the former demonstrated a statistically significant and clinically meaningful improvement in progression-free survival.

Progression-free survival (PFS) essentially measures how long a patient lives with their disease without it getting worse.

Ivonescimab in combination with chemotherapy also showed a positive trend in overall survival in the primary analysis, but without achieving a statistically significant benefit. Overall survival reflects the extent to which a treatment can extend a patient’s lifespan.

However, there are no current FDA-approved regimens that have demonstrated a statistically significant overall survival benefit in this patient setting, the company said.

Furthermore, the safety profile of Ivonescimab plus chemotherapy was acceptable and manageable in the context of the observed clinical benefit, the company said.

Summit now intends to file a Biologics License Application (BLA) with the U.S. Food and Drug Administration seeking approval for Ivonescimab plus chemotherapy based on the results of the trial. The company did not specify a specific timeline for filing the application.

Meanwhile, according to the firm, the FDA has said that a statistically significant overall survival benefit is necessary to support marketing authorization, which will weigh into its consideration of the timeline for filing the application.

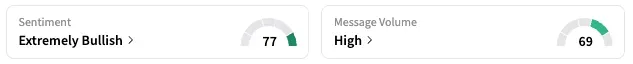

On Stocktwits, retail sentiment around SMMT jumped from ‘bearish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘low’ to ‘high’ levels.

A Stocktwits user opined that the company is overvalued.

SMMT stock is up by about 3% this year and about 74% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<