Bitcoin fell over 8% during U.S. trading, extending a 20% retreat from its January high of around $109,000.

Crypto-linked stocks tumbled Tuesday as Bitcoin (BTC) dropped below $90,000, intensifying a sell-off across digital asset markets.

Strategy (MSTR) and Robinhood (HOOD) were among the hardest-hit stocks, each plunging more than 10% in early trading.

The apex cryptocurrency fell over 8% during U.S. market hours, extending its decline to 20% from its all-time high of around $109,000 in January. Bitcoin briefly dipped below $87,000 before stabilizing in the $87,000 to $89,000 range.

The sell-off came amid broader market jitters, with weakness in technology stocks and strength in the Japanese yen suggesting investors were shifting toward safer assets. Geopolitical tensions under the Trump administration further weighed on sentiment.

Strategy, which holds the largest Bitcoin reserves among public companies, dropped to a three-month low.

Meanwhile, Robinhood erased all its month-to-date gains.

Shares of crypto trading platform Coinbase (COIN) fell to 2-month lows, dipping by around 7.5% on Tuesday, after a 9% drop during the previous session.

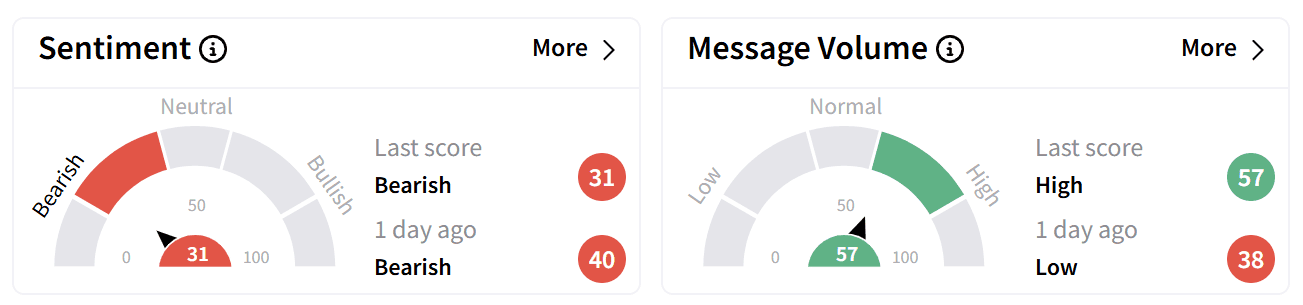

However, among the three, only one reflected a bearish retail sentiment.

On Stocktwits, retail sentiment around Strategy dug deeper into the ‘bearish’ territory even as chatter increased to ‘high’ levels from ‘low’ a day ago.

The decline comes after the company disclosed it had purchased another $2 billion worth of Bitcoin, bringing its total holdings to just under 500,000 BTC.

While the move reinforces Strategy’s commitment to Bitcoin, it has also raised concerns about dilution, with analysts and investors questioning the sustainability of its aggressive accumulation strategy.

While Strategy’s stock is down over 17% so far in 2025, it has held onto gains of over 300% over the past year.

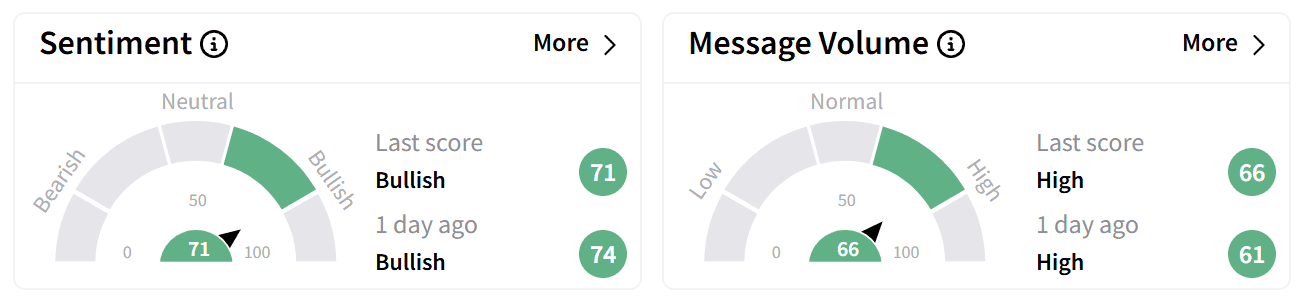

Meanwhile, retail sentiment around the crypto exchanges showcased a more optimistic picture.

Retail sentiment around Robinhood’s stock on Stocktwits remained ‘bullish’ despite the market downturn.

The optimism stemmed from the brokerage’s most recent earnings. Its revenue doubled year-over-year to over $1 billion, beating Wall Street’s average estimate. Its earnings per share (EPS) were double the expected $0.45 at $1.01.

A key driver of Robinhood’s performance was a 200% increase in transaction-based revenue to $672 million, with cryptocurrency trading revenue surging 700% to $358 million.

Robinhood’s stock has been falling for six consecutive sessions despite news that the U.S. Securities and Exchange Commission (SEC) officially closed its investigation into Robinhood Crypto. However, it remains up 20% year-to-date.

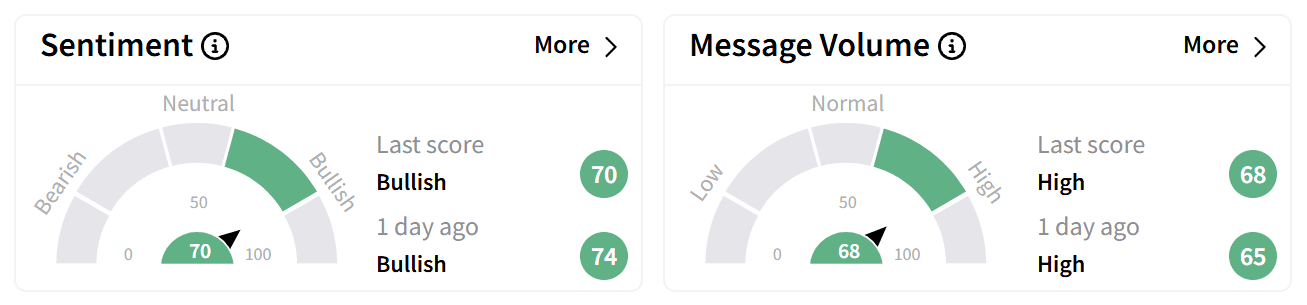

Retail sentiment around Coinbase was also ‘bullish’ accompanied by a marginal uptick in chatter as users backed the company’s valuation over the volatility in Bitcoin’s prices.

Coinbase’s stock has also been on a six-day losing streak, but unlike Robinhood, its price is down 17% in 2025.

While Bitcoin’s plunge weighs on crypto stocks, retail traders remain divided on what comes next.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Bitcoin Slides To 3-Month Low Dragging Crypto Market Cap By 10% Amid Mounting Macroeconomic Pressures, Risk Averse Sentiment