According to the Finchat-compiled consensus, the Stockholm-based company is expected to report earnings per share of 2.21 euros and revenue of 4.2 billion euros.

Shares of music streaming service Spotify Technology SA (SPOT) have gained nearly 38% for the year-to-date period, even as the S&P 500 is down 6%. The stock is in the spotlight ahead of the company’s quarterly earnings, due Tuesday before the market opens.

According to the Finchat-compiled consensus, the Stockholm-based company is expected to report earnings per share (EPS) of 2.21 euros and revenue of 4.2 billion euros. Spotify’s guidance calls for revenue of 4.2 billion euros for the quarter.

This compares to the year-ago numbers of 0.97 euros and 3.64 billion euros, respectively, and the preceding quarter’s 1.76 euros and 4.24 billion euros.

The company had guided to a first-quarter gross margin of 31.5% and operating income of 548 million euros.

Spotify expects its first-quarter monthly active users (MAU) to be 678 million and total premium subscribers to be 265 million.

Previewing the quarterly results, Macquarie analyst Ross Compton said he expects 11% year-over-year (YoY) subscriber growth to 265 million, helping drive MAUs by 10% to 678 million. The analyst’s forecast for a moderation in subscriber growth is due to the company’s high penetration in most developed markets.

The analyst said, “This drives urgency to monetize user segments more efficiently (potential Premium tier) and accelerate advertising efforts.”

He also said the recent negotiations with label groups suggest tempered gross margin growth in 2025. That said, he expects video podcasts and audiobooks to offer the potential for expanding gross margins.

Macquarie sees risk for advertising revenue due to brand spend pullback in tariff turmoil. However, the brokerage expects the programmatic ad platform and measurement capabilities unveiled at the company’s SAX event underscore its ambition to become an advertising behemoth.

The firm maintained an ‘Outperform’ rating and upped the price target for Spotify stock to $665 from $600, citing Spotify’s focus on profitability.

On Stocktwits, retail sentiment toward Spotify stock remained ‘extremely bullish’ (88/100) by late Sunday, and the message volume improved to ‘extremely high.’

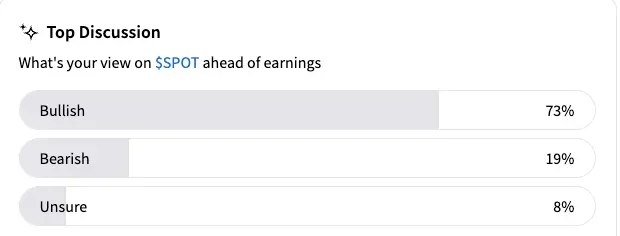

An ongoing Stocktwits poll that asked users their views on Spotify ahead of earnings found that 73% of the respondents were bullish.

A bullish watcher suggested Spotify, Palantir (PLTR) and Netflix (NFLX) are the only three stocks worth buying.

Another user pointed to a double-bottom base breakout technical pattern and suggested that the stock could reach $700 following the earnings.

Spotify stock ended Friday’s session up 2.44% at $620.72. The Koyfin-compiled consensus analysts’ price target for the stock is $672.02, implying an 8.3% upside from Friday’s close.

(Note: 1 euro =$1,13)

For updates and corrections, email newsroom[at]stocktwits[dot]com.<