By integrating S&P Global’s data into Claude’s GenAI platform, finance professionals can gain instant access to verified financial insights, enabling them to analyze trends, credit ratings, and market capitalizations.

S&P Global Inc. (SPGI) on Tuesday unveiled a partnership with AI firm Anthropic to integrate its expansive financial databases into Claude, Anthropic’s generative AI assistant. This will give finance professionals instant, conversational access to trusted market data.

The collaboration will enable users, such as hedge fund managers, private equity professionals, and investment analysts, to engage directly with S&P Global’s insights through Claude’s GenAI platform.

S&P Global stock inched higher by 0.03% on Tuesday morning.

Kensho, the AI research division of S&P Global, developed a server based on the Model Context Protocol (MCP).

This open standard, originally introduced by Anthropic, connects large language models (LLM) with structured data sources. With Kensho’s LLM-compatible Application Programming Interface(API), Claude can now retrieve information such as S&P Capital IQ Financials, corporate earnings call transcripts, and other select financial datasets directly within the conversational interface.

By embedding S&P’s data into the GenAI ecosystem, users can ask financial questions such as revenue growth trends, credit rating shifts, or market cap comparisons and receive answers grounded in vetted data.

The effort is part of Anthropic’s broader Financial Analysis Solution, a targeted suite of tools designed to enhance decision-making for capital markets clients.

The AI startup launched its AI-powered toolset, Financial Analysis Solution, integrated with Claude on Tuesday, to help finance professionals quickly analyze markets and build models.

The solution also emphasizes security, with Anthropic stating that client data will not be used to train AI models. Claude can now act as a research assistant, due diligence analyst, and memo generator, helping finance teams move faster and improve the accuracy of their decision-making.

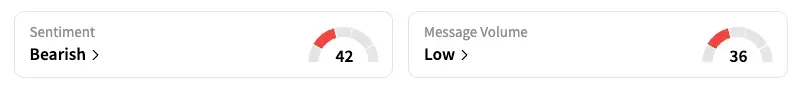

On Stocktwits, retail sentiment toward S&P Global shifted to ‘bearish’ from ‘neutral’ territory the previous day amid ‘low’ message volume levels.

S&P Global stock has gained over 6% year-to-date and over 9% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<