Guggenheim cited softer long-term R2/R3 assumptions driven by softer R1 sales, negative U.S. electric vehicle and emissions policy changes as the reasons for the downgrade.

Guggenheim analyst Ronald Jewsikow on Monday downgraded EV maker Rivian Automotive (RIVN) to ‘Neutral’ from ‘Buy’, citing softer long-term R2/R3 assumptions driven by softer R1 sales and negative U.S. electric vehicle and emissions policy changes.

Rivian currently manufactures consumer vehicles referred to as R1, including the R1T truck and the R1S SUV. The company is now planning on launching more vehicle models, including the R2 SUV and the R3 crossover.

Guggenheim remains confident in cost-reduction targets for the R2. Still, the firm no longer has confidence in the required volumes and/or required average selling price (ASP) to support the prior price target, the analyst told investors in a research note, as per TheFly.

Softening R1 demand is a modest negative for R2 and R3 volumes, and the loss of EV incentives is likely to negatively impact long-term ASP and/or volume potential as well, the firm noted.

Earlier this month, Rivian said that it delivered 10,661 vehicles in the second quarter, marking a decline of 23% from the corresponding period of 2024.

The company produced only 5,979 vehicles at its manufacturing facility in Normal, Illinois, in the period, down from the 9,612 vehicles produced in the second quarter (Q2) of 2024.

The company reaffirmed its 2025 delivery guidance range of 40,000 to 46,000 vehicles, down from the 51,579 delivered in 2024.

The R1S SUV and the R1T truck are priced around $70,000. Rivian also sells electric delivery vans to fleet owners, such as Amazon.com Inc., priced at around $80,000.

The R2 SUV, however, is expected to be priced around $45,000 and compete against Tesla Inc.’s (TSLA) best-selling Model Y SUV once launched in the first half of 2026. R3 crossover production is expected to follow afterwards.

The company is currently undertaking construction at its Normal plant to prepare for R2 manufacturing. Rivian is also planning to shut down its production line at its Illinois factory for about a month in the second half of the year to prepare for the start of R2 production.

Meanwhile, President Donald Trump signed the Republican tax bill into law on the Fourth of July. Under the new law, tax credits for the purchase of electric vehicles will expire on Sept. 30. This includes the $7,500 federal tax credit on the purchase of new EVs and the $4,000 credit on buying used ones.

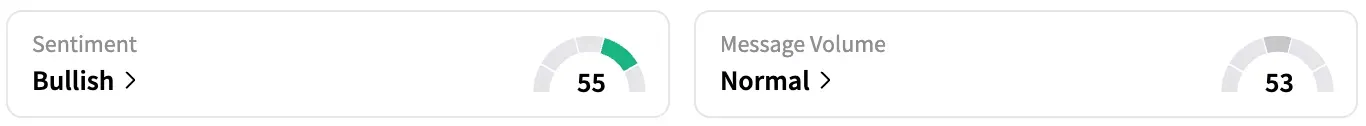

On Stocktwits, retail sentiment around Rivian remained within the ‘bullish’ territory over the past 24 hours, while message volume fell from ‘high’ to ‘normal’ levels.

RIVN stock is down by 5% this year and by over 27% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<