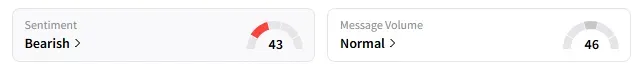

Following Rigetti’s announcement, retail sentiment around Rigetti on Stocktwits dipped into the ‘bearish’ territory from ‘bullish’ the previous day.

Shares of Rigetti Computing Inc.(RGTI) declined over 7% on Friday after the company initiated an at-the-market (ATM) equity offering program that could generate up to $350 million in proceeds.

Under the arrangement, Jefferies LLC will act as the sales agent, facilitating stock sales directly on the open market on Rigetti’s behalf.

The quantum and timing of these share issuances will depend entirely on the company's discretion. The offering enables Rigetti to issue shares incrementally, as needed.

Rigetti has been offering cloud-based quantum services since 2017 and on-premises systems since 2021. The company designs and manufactures its chips at Fab-1, a dedicated quantum device production facility.

At the end of April, Rigetti closed an investment deal with Quanta Computer Inc., with the latter acquiring roughly $35 million worth of Rigetti common stock at a price of approximately $11.59 per share.

Rigetti also received a research award from the Air Force Office of Scientific Research to advance its innovative chip fabrication method, Alternating-Bias Assisted Annealing (ABAA).

Rigetti devices produced using the ABAA technique have demonstrated a decrease in two-level systems (TLSs). TLS is a defect in qubits that can degrade performance by either draining energy or causing dephasing.

For the first quarter, Rigetti’s revenue slumped 51.7% year-on-year to $1.47 million, missing the analyst consensus estimate of $2.55 million, as per Finchat data.

On Stocktwits, retail sentiment around Rigetti changed to ‘bearish’ from ‘bullish’ the previous day.

A Stocktwits user said news doesn't make the dip worth jumping on.

Rigetti stock has lost over 17% year-to-date and has increased tenfold in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<