Earnings and incremental market opportunities are buoying sentiment toward these stocks.

The S&P 500 Index retreated from the record high it hit last week despite the consumer price inflation report coming in line with expectations, cementing hopes of another rate cut. The pullback may have to do with profit-taking as traders digested the breathtaking rally seen this year.

Futures are pointing to a firmer start on Friday, with a strong earnings report from artificial intelligence-levered networking chipmaker Broadcom, Inc. ($AVGO) potentially providing the impetus.

Here are a few stocks that are making waves on the Stocktwits platform, garnering the most bullish reaction from the retail crowd:

Quanex Building Products Corp. ($NX)

Houston, Texas-based Quanex is a provider of components for the fenestration industry in the U.S. and the international markets.

The company reported fiscal year 2024 fourth-quarter adjusted net income that fell sharply from $0.95 a year ago to $0.61. The bottom-line results, however, exceeded the $0.56 consensus estimate. Revenue climbed nearly 67% to $492.2 million versus the average analysts’ estimate of $490.96 million.

The stock fell in premarket trading as the company said soft demand will likely persist until the spring selling season. However, it expects the results to improve in the second half of 2025 due to the typical seasonality. combined with the benefit from unwinding pent-up demand as interest rates continue to trend lower and consumer confidence improves.

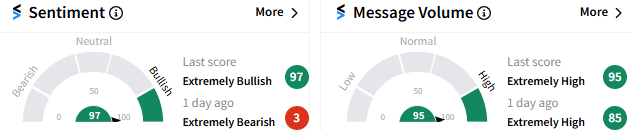

On Stocktwits, sentiment toward Quanex is ‘extremely bullish’ (97/100), reversing from the ‘extremely bearish’ mood that prevailed a day ago. This matched the upbeat sentiment seen in early September. Trader chatter improved, as reflected by an increase in message volume to ‘extremely high’ levels.

Ciena Corp. ($CIEN)

Shares of Ciena, a networking systems, services, and software company based in Hanover, Maryland, are on track to see follow-on buying interest on Friday. The stock rallied over 15% on Thursday despite the company’s mixed fiscal year 2024 fourth-quarter results.

Reviewing the results, Barclays analysts raised the price target for Ciena shares from $67 to $97, citing the company’s above-consensus 2025 and long-term guidance, TheFly reported. The analysts expect the margin headwinds to turn into a tailwind in 2026 as the company ships the most line systems ever in the current fiscal year.

Retail traders on Stocktwits maintained an ‘extremely bullish’ stance (97/100) on Ciena stock, with the buoyant mood accompanied by an ‘extremely high’ message volume.

Himax Technologies, Inc. ($HIMX)

Himax shares fell nearly 3% in premarket trading on Friday following an almost 45% jump in the previous session. Thursday’s rally came on the back of a comment from TFI Securities analyst Ming-Chi Kuo regarding the company likely entering the supply chain for Taiwan Semiconductor Manufacturing Co. Ltd’s ($TSM) co-packaged options (CPO) and Nvidia Corp.’s ($NVDA) next-generation artificial intelligence (AI) chips Rubin series.

Late Thursday, Baird analyst Tristan Gerra upped the price target for Himax stock from $5 to $7 and maintained an ‘Outperform’ rating, citing CPO and augmented reality (AR) opportunities.

Stocktwits users held an ‘extremely bullish’ sentiment (97/100) toward the stock, an improvement from a ‘neutral’ mood that prevailed a day ago. Message volume also spurted to ‘extremely high.’

The stock is up about 66% this year.

TruGolf Holdings, Inc. ($TRUG)

Penny stock TruGolf is poised to see a strong upward momentum for a second straight session. After rising 17.66% on Thursday on abnormally heavy volume, the stock is up over 27% in the premarket session on Friday.

Centerville, Utah-based TruGolf develops indoor golf simulator hardware under the TruGolf Nevada brand for residential and commercial markets in the U.S.

On Stocktwits, retail is ‘extremely bullish’ (97/100) on the stock, a turnaround form the ‘bearish’ mood that prevailed a day ago. Trader chatter about the stock is brisk, with the message volume rising to ‘extremely high’ levels.

A platform user flagged a potential short-squeeze taking the stock to double digits very quickly.

According to Yahoo Finance data, about 3.67% of the outstanding shares are held as short.

Broadcom

Broadcom shares jumped 14.50% in premarket trading on Friday after the Palo Alto, California-based chipmaker reported fiscal year fourth-quarter non-GAAP EPS of $1.42 on revenue of $14.05 billion. While the bottom line beat estimates, revenue was just shy of expectations.

The company guided fiscal year 2026 first-quarter revenue slightly above the consensus.

Sentiment toward Broadcom stock stayed ‘extremely bullish’ (96/100), with message volume remaining ‘extremely high.’

The stock has gained about 64% for the year.

Following the results, Baird analyst Tristan Gerra upped the price target for Broadcom stock from $195 to $210 and maintained an ‘Outperform’ rating. The analyst was positive about the two additional custom ASIC customers announced by the company and the artificial intelligence (AI) serviceable addressable market (SAM) guidance that implied three-year compounded annual growth rate of 60%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<