The company signaled that it could expand into urban markets of the U.S. Southeast.

Pinnacle Financial Partners (PNFP) gained marginally in premarket trade after topping Wall Street’s estimates for quarterly profit.

However, its first-quarter revenue of $462.85 million missed analysts’ expectations of $478.54 million, according to FinChat data.

The parent company of Pinnacle Bank reported adjusted earnings of $1.90 per share for the three months ended March 31, while Wall Street expected it to post earnings of $1.80 per share.

Its net income rose to $1.77 per share for the first quarter, compared with $1.57 per share a year earlier.

The company’s net interest income rose to $364.4 million, compared with $318 million in the year-ago quarter.

Its noninterest-bearing deposits grew by $336.9 million during the quarter, which implies an annualized growth rate of 16.5%.

Its interest earnings assets rose 11% year-over-year during the first quarter, and its net interest margin was 3.21%, compared to 3.04% a year earlier.

"There is great volatility and economic uncertainty associated with tariffs, taxes and other policy changes," CEO Terry Turner said.

However, the company reiterated its year-end loan portfolio growth forecast for 2025 at between 8% and 11%.

“Despite the current economic uncertainties, we will continue to invest in future growth by recruiting the best bankers in our existing markets and, if the right talent becomes available, we would also consider extending into other large, urban markets in the Southeast," Turner said.

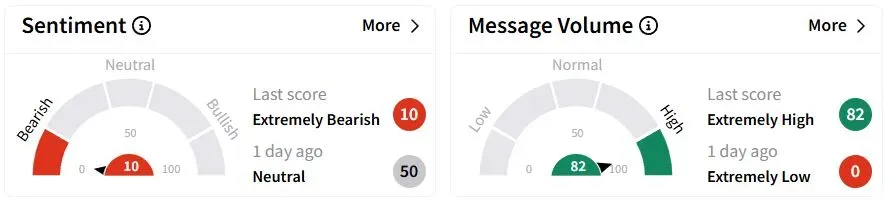

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (82/100) territory from ‘neutral’(53/100) a day ago, while retail chatter remained ‘neutral.’

One bearish retail trader wondered if the stock would hit $80.

Pinnacle Financial shares have fallen 20.2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<