The stock has pulled back about 15% since it hit an all-time closing high on Tuesday, following reports of a U.S. defense spending cut and CEO Alex Karp’s new stock trading plan.

Palantir Technologies, Inc. (PLTR) stock has pulled back about 15% since it hit an all-time closing high of $124.62 on Tuesday, following reports of a U.S. defense spending cut and CEO Alex Karp’s new stock trading plan.

However, an analyst at Wedbush wasn’t deterred by the downside catalysts.

In a note released Thursday, analyst Daniel Ives slammed the latest “silver bullet negative thesis” of bears that Palantir is exposed to the rumored 8% annual defense spending cuts. The analyst said he holds an opposing view.

According to Ives, the Denver, Colorado-based artificial intelligence (AI)-powered data analytics company’s unique software approach will enable it to gain more IT budget dollars at the Pentagon.

The analyst said, “Palantir is so well positioned for this new disciplined spending environment at the Pentagon and this will ultimately be a positive growth catalyst as the various programs are scrutinized.”

President Donald Trump’s stepped-up AI investments and Project Stargate should benefit Palantir as more organizations within the government look to build strategic AI infrastructure, he added.

Ives noted that Palantir has received Federal Risk And Authorization Management Program (FedRAMP) authorization for its entire cloud service offering, allowing it to sell its products across the U.S. government.

Wedbush has an ‘Outperform’ rating and a $120 price target for Palantir stock.

In a video shared by the Department of Defense on X, Secretary of Defense Pete Hegseth said the 8% cuts reported by media are not cuts per se but reorienting the budget toward Trump’s priority of building a “lethal fighting force.”

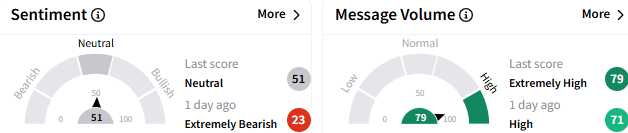

On Stocktwits, retail sentiment toward Palantir stock was ‘neutral’ (51/100), although an improvement from the ‘bearish’ mood that prevailed a day ago. The Palantir stream on the platform continued to attract an ‘extremely high’ message volume.

A retail watcher raised the possibility of a “bloody Friday” for the stock.

Another user, however, expected long-term-oriented institutional buyers to keep adding the stock.

Palantir ended Thursday’s session down 5.17% at $106.27, although it is still up over 40% so far this year.