The company expects gross proceeds of approximately $1.6 billion if all warrants are exercised.

Occidental Petroleum Corp (OXY) shares edged 0.8% lower on Monday after the company announced an offer to exercise its outstanding publicly traded warrants at a temporarily reduced price.

The company expects gross proceeds of approximately $1.6 billion if all warrants are exercised.

The company initially distributed these warrants on Aug. 3, 2020, as a dividend. Occidental said holders have the opportunity to exercise each of their warrants at a temporarily reduced exercise price of $21.30 compared to $22.00.

The company clarified that the offer does not have a minimum participation requirement.

Occidental said it intends to use the proceeds for general corporate purposes, which may include the redemption or repayment of certain of its outstanding indebtedness.

Occidental stock is currently trading near the $48.50 level.

The stock has been in the news lately after Warren Buffett’s Berkshire Hathaway increased its stake in the company to over 28%.

Last month, the company announced that it had achieved its near-term debt repayment target of $4.5 billion in the fourth quarter of 2024 and that proceeds from $1.2 billion of divestitures signed in the first quarter of 2025 will go toward current-year debt maturities.

“Occidental will continue to advance deleveraging via free cash flow and divestitures,” it had said.

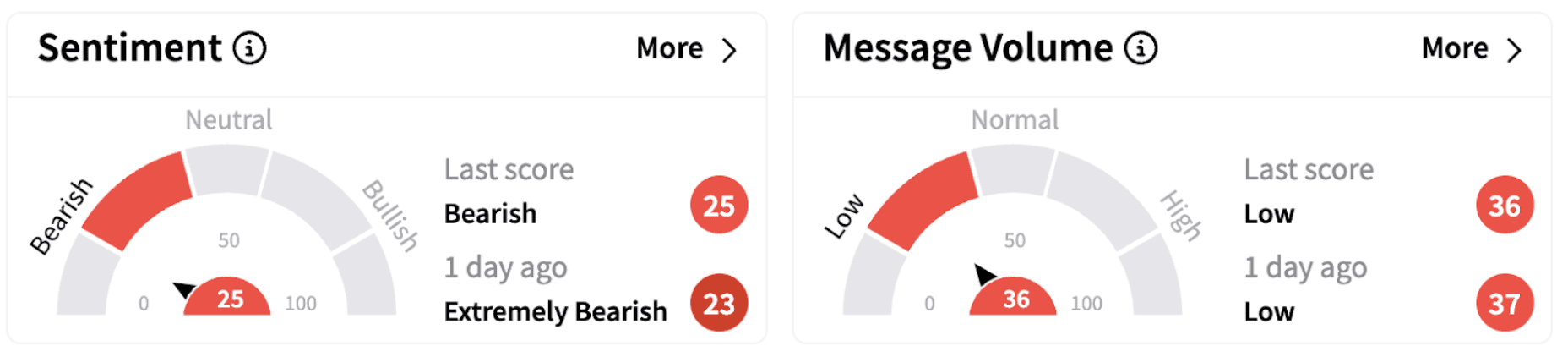

On Stocktwits, retail sentiment surrounding the stock inched up marginally but continued to trend in the ‘bearish’ territory (25/100).

According to TheFly, Wells Fargo recently lowered its price target on Occidental Petroleum to $52 from $53 while keeping an ‘Equal Weight’ rating on the shares. At the same time, Roth MKM also lowered its price target to $53 from $54 while keeping a ‘Neutral’ rating.

OXY shares are down over 2% in 2025 and have lost 20% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<