The survey showed that median inflation expectations increased by 0.5 percentage points to 3.6% at the one-year-ahead horizon.

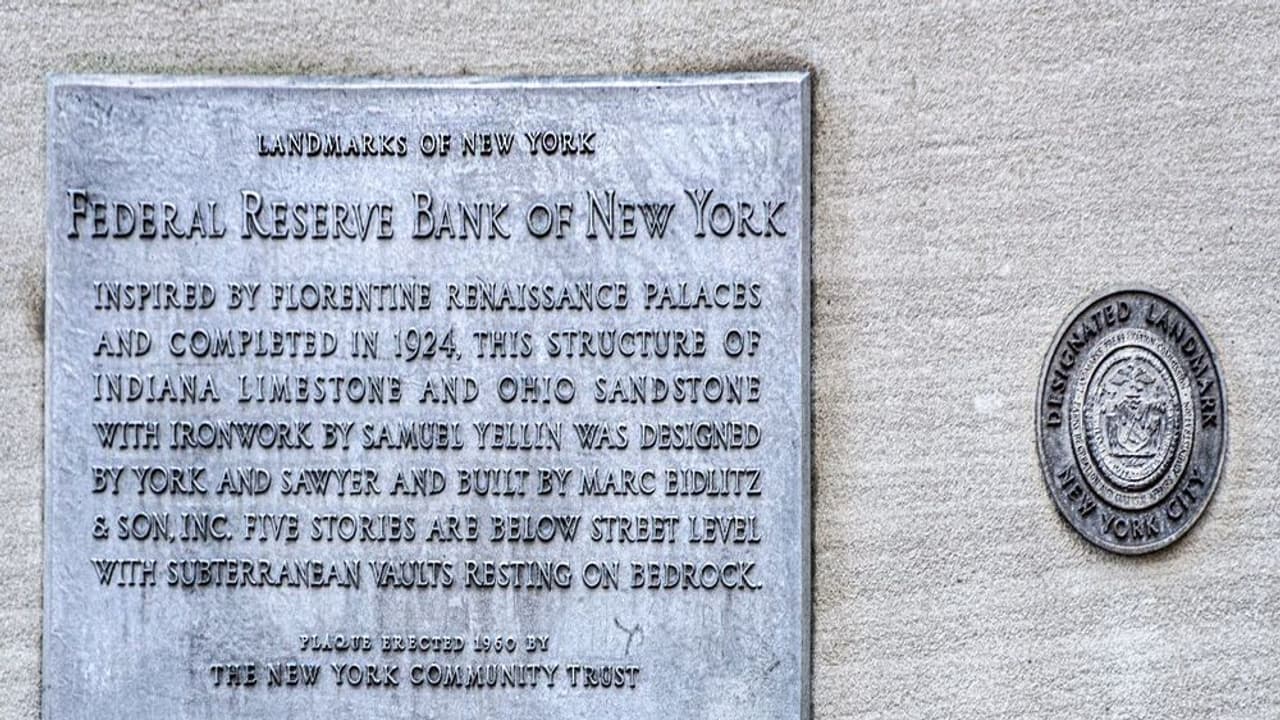

The Federal Reserve Bank of New York’s March Survey of Consumer Expectations showed that short-term inflation expectations have risen while unemployment, job loss, and earnings growth expectations have deteriorated.

The survey showed that median inflation expectations increased by 0.5 percentage points to 3.6% at the one-year-ahead horizon.

At the same time, mean unemployment expectations rose 4.6 percentage points to 44%, hitting the highest level since April 2020.

The survey also reflected that the mean perceived probability of losing one’s job in the next 12 months increased by 1.6 percentage points to 15.7%, marking the highest level since March 2024.

Notably, the median expected growth in household income fell by 0.3 percentage points to 2.8% in March.

"The decline was most pronounced for respondents with at most a high school degree and for those with annual household incomes under $50,000,” the survey noted.

Consumers also expressed angst regarding access to credit. Perceptions of credit access compared to a year ago indicated that a larger share of households reported that it is harder to get credit.

Meanwhile, perceptions about households’ current financial situations deteriorated marginally compared to a year ago, with a larger share of households reporting a worse financial situation.

The ongoing tariff wars have sparked fears about a spike in inflation. However, the possibility of a slowdown in economic growth is another factor keeping the markets on edge.

Given these factors, the Federal Reserve will have a tough job deciding the trajectory of monetary policy in the coming months.

According to the CME FedWatch Tool, futures traders are factoring in three rate cuts in 2025, with the first reduction expected in June.

Meanwhile, major Wall Street indices traded in the green on Monday at noon. The SPDR S&P 500 ETF Trust (SPY), which tracks the S&P 500, was up 0.46% while the Invesco QQQ Trust, Series 1 (QQQ), tracking the Nasdaq Composite, rose 0.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<