Morgan Stanley underscored that Nvidia's growth drivers continue to be in good health—this includes Blackwell supply visibility, near-term business prospects, and customer spending desires.

Shares of Nvidia Corp. (NVDA) gained nearly 3% in mid-day trade on Thursday after analysts at Morgan Stanley shrugged off the DeepSeek sell-off.

Since DeepSeek’s launch on Jan. 24, Nvidia’s stock has lost over 10% of its value.

In its latest note, Morgan Stanley underscored that Nvidia's growth drivers continue to be in good health — this includes Blackwell supply visibility, near-term business prospects, and customer spending desires.

The brokerage noted that DeepSeek has created “some headwinds” for Nvidia around export controls and expects governments “will do something,” but it is not sure exactly how that will be done.

It called DeepSeek’s launch an “evolutionary upgrade” rather than a revolutionary one.

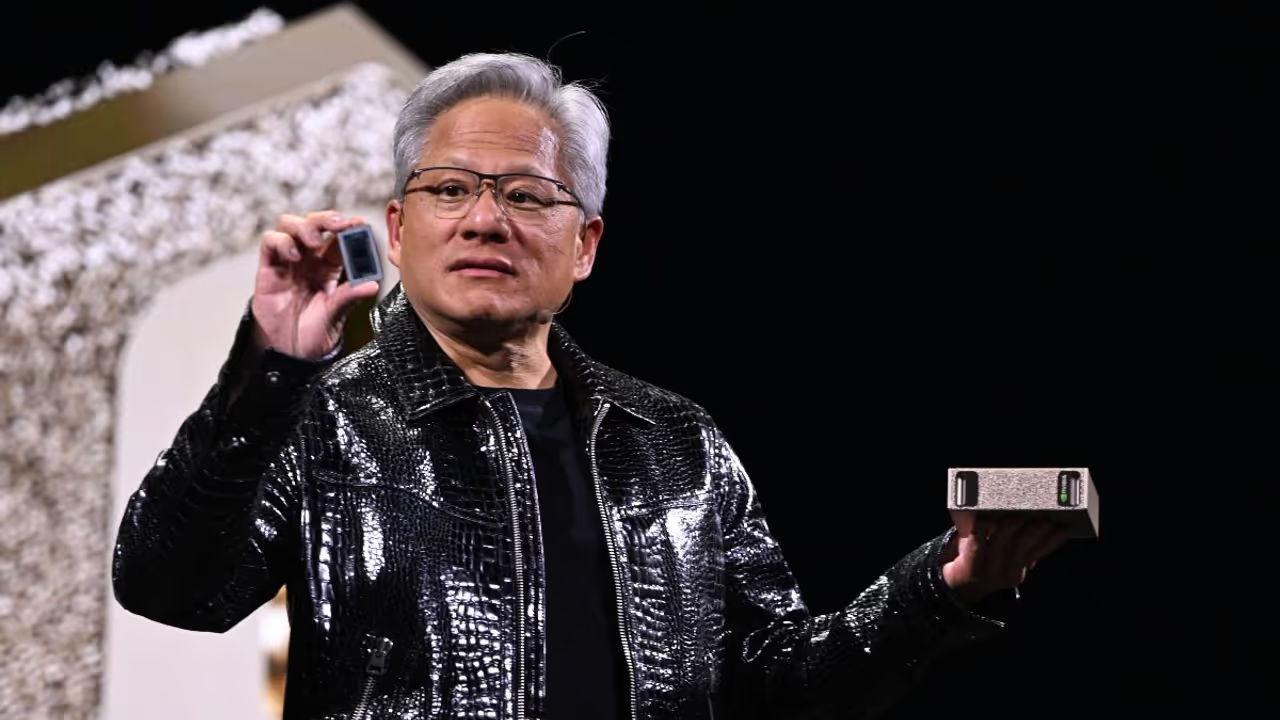

“In a space where the CEO of NVIDIA has said that they have improved AI performance at the processor level by one million x in the last decade and will do so again in the next decade, some deflation is not surprising,” the brokerage said.

However, it added that it has not yet heard any change of plans from any of the major participants. Inference, another area where Nvidia is strong, is also on a clear growth path for the artificial intelligence (AI) bellwether, according to Morgan Stanley.

It maintained Nvidia as its top pick with an ‘Overweight’ rating. Its price target for the Nvidia stock is $152, which implies an upside of nearly 19%.

Retail sentiment on Stocktwits around the Nvidia stock remained in the ‘bullish’ (65/100) territory at the time of writing, while message volume was in the ‘high’ (61/100) zone.

Meanwhile, one user thinks the Nvidia stock is “oversold.”

Nvidia’s share price has gained over 22% in the last six months, while its one-year returns stand at more than 87%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<