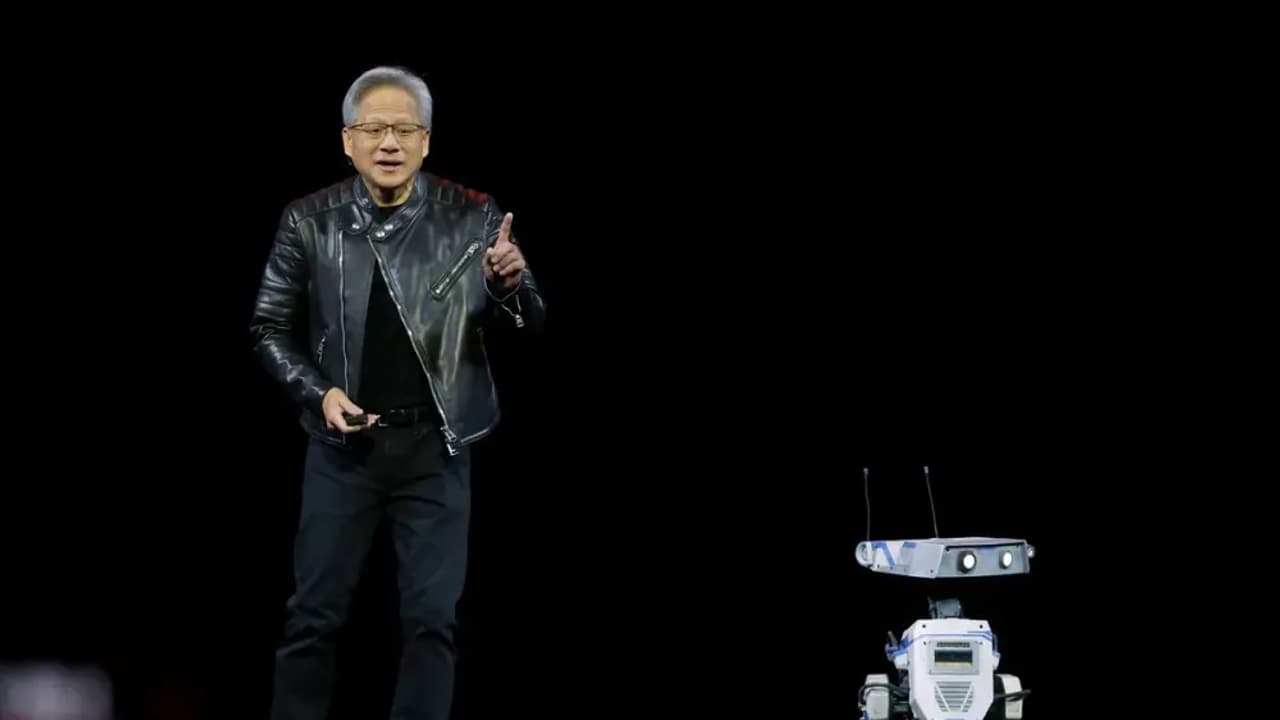

The brokerage expressed a bullish outlook for the company and the broader artificial intelligence (AI) sector as the Jensen Huang-led AI bellwether made a slew of announcements at the ongoing GTC 2025 event.

Nvidia Corp. (NVDA) stock will be in focus on Wednesday after analysts at Wedbush expressed a bullish outlook for the company and the broader artificial intelligence (AI) sector as the Jensen Huang-led AI bellwether made a slew of announcements at the ongoing GTC 2025 event.

From an open-source foundational model for humanoid robots to a new Blackwell chip, new graphics processing units (GPU), and more, Nvidia’s first day of GTC 2025 was action-packed.

The company also announced partnerships with Alphabet Inc.’s Google and its subsidiary DeepMind, Disney Research, General Motors, and several others to cater to the needs of its clients and end users across industries, exhibiting the breadth of its influence and just how many companies rely on Nvidia chips.

In its latest research note to clients, Wedbush underscored this and highlighted that the demand for Blackwell remains “robust” despite the initial concerns of overheating.

According to the brokerage, Blackwell's demand is currently outstripping supply 15:1.

“Nvidia's chips remain the new oil or gold in this world for the tech ecosystem as there is only one chip in the world fueling this AI foundation, and it’s Nvidia,” observed Wedbush analysts, led by tech bull Dan Ives.

According to the brokerage, driving the demand for Blackwell chips is the 100x jump in computational resources than what was initially estimated by companies. Nvidia is planning a powerful version for the second half of 2025 to address these growing performance requirements.

On the whole, Wedbush said for every $1 spent on an Nvidia chip, there is a $8 to $10 multiplier across the tech ecosystem, pegging its capital expenditure at $3 trillion over the next three years.

On Stocktwits, retail sentiment around Nvidia surged to enter the ‘bullish’ (56/100) territory from ‘bearish’ (49/100) a day ago.

One user was unperturbed by the fall in Nvidia’s stock on Tuesday, saying that it “should go back up” now.

Data from Koyfin shows the average price target for Nvidia is $172.50, implying an upside of over 49% from current levels.

Of the 61 analyst ratings for the Nvidia stock, 56 have a ‘Buy’ or ‘Strong Buy’ rating, while five have a ‘Hold’ recommendation.

Nvidia’s stock is down over 14% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<