Trump eyes 60% or higher tariffs on Chinese goods but economists think a blanket 40% rate looks likely.

Nvidia Corp. ($NVDA) shares fell in Thursday’s premarket session as traders looked past the quarterly beat and expressed disappointment over the running quarter’s guidance.

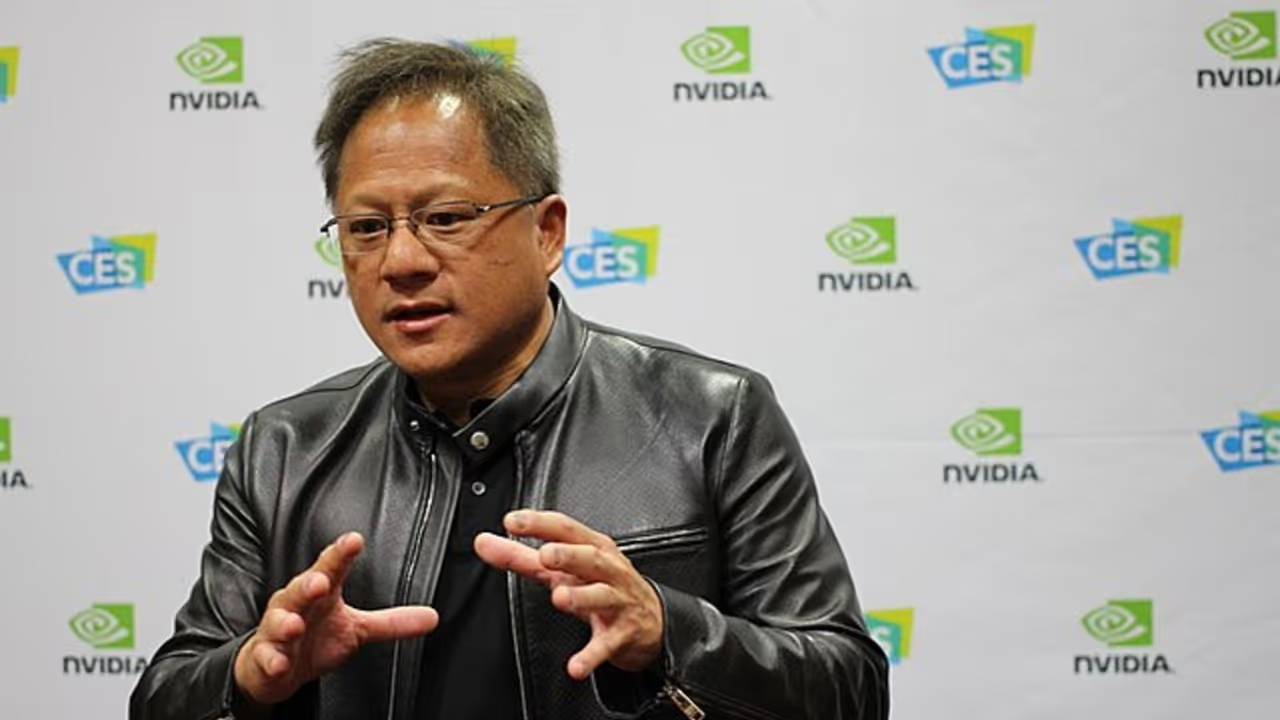

On the earnings call, Jensen Huang, President and CEO of the artificial intelligence (AI) chip maker, weighed in on the proposed tariff policy of the incoming administration under President-elect Donald Trump.

During his campaign, Trump threatened to impose 60% or higher tariffs on Chinese goods if he were to be elected.

The results of a Reuters poll of economists published on Wednesday showed that Trump would start off by imposing a blanket 40% tariff on goods imported from China. This is sharply higher than the 7.5%-25% rate he levied while he was in office between 2017 and 2020.

The poll respondents, which includes economists from in and outside of mainland China, said a 60% tariff as early 2025 is unlikely as it would reignite inflationary pressure in the U.S., the report said.

A radical measure such as this could trigger retaliation by China and precipitate into a trade war between the world largest and second-largest economies.

Huang was asked about how the proposed tariffs would impact Nvidia’s China business.

The executive said Nvidia would support the administration in whatever it decides. "And that’s our - the highest mandate," he said. "And then after that, do the best we can and just as we always do," he added.

Outlining the three things the company would do simultaneously, Huang said it would comply with any regulation fully, support its customers to the best of its abilities and also compete in the marketplace.

Nvidia is facing the brunt of the Joe Biden administration’s decision to ban the export of high-performance chips to China. To offset any potential negative impact from the move, the company developed export-compliant Hopper products.

On the earnings call, CFO Colette Kress said China data center revenue increased sequentially in the third quarter due to the shipments of these export-compliant products. That said, China’s contribution to data center revenue remained well below the levels that prevailed ahead of the export controls, she added.

The 10-Q report filed with the SEC showed that China, including Hong Kong, contributed $5.42 billion or 15.5% to Nvidia's total revenue of $35.08 billion. The region witnessed roughly 34% YoY growth.

On Stocktwits, sentiment toward Nvidia stock stayed ‘extremely bullish’ (80/100), with message volume ‘extremely high.’

In Thursday’s premarket session, as of 7:57 am ET, the stock clawed back early losses and was down merely 0.86% at $144.64.