The sportswear giant forecast fiscal first-quarter revenue above expectations but warned it still faces significant exposure to tariffs.

Nike (NIKE) allayed investor concerns on Thursday with better-than-expected fourth-quarter results and revenue forecast for the current quarter, signaling that its turnaround effort was on track.

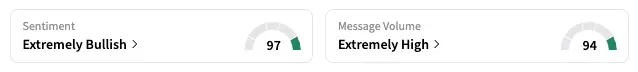

Shares gained 11% in extended trading, and retail sentiment inched higher to nearly the highest level possible (97/100). As of writing, Nike was the number 2 trending ticker on Stocktwits.

If the gains hold in Friday's session, it would be only the second time Nike shares have gained over 10% intraday in two and a half years.

The sports apparel and footwear company forecast first-quarter revenue to fall in the mid-single digits, slightly better than analysts' expectations of a 7.3% drop from LSEG/Reuters.

In Q4, sales declined 12% to $11.10 billion, but exceeded the estimated $10.72 billion. Profit fell to $0.14 per share from $0.99 per share in the year-ago quarter. Analysts were expecting $0.12 per share.

Retail investors were already quite optimistic heading into the earnings report. The sentiment on Stocktwits jumped several notches higher in the 'extremely bullish' territory, and message volume jumped to 'extremely high' from 'high' after the report.

Much of the enthusiasm around the stock stems from investor belief that it has likely hit its bottom, with expectations of upside from here on. Nike shares are currently trading at about one-third of their November 2021 peak and are down roughly 20% year-to-date.

"The ER (earnings report) numbers mean NOTHNG NOW, except for the fact that they can't get worse and MM's (market makers) know this," a user said, forecasting that the stock could double in one or two years.

Turnaround In Progress

Management indicated that its turnaround plan, including inventory cleanup for upcoming collections and a renewed direct-selling partnership with Amazon, was showing results.

CEO Elliott Hill pitched "a clear path to recovery ahead" to investors and analysts on the company's conference call. "From here, we expect our business results to improve," he said. "It's time to turn the page."

CFO Matt Friend stated that the inventory cleanup is proceeding as planned, and Nike is on track to conclude the first half of the current fiscal year in a "healthy and clean position."

The company is also relocating a part of its manufacturing operations out of China, where it faces a high duty on imports. It currently imports 16% of its footwear sold in the U.S. from China and expects to reduce this to mid-single digits by the end of the current fiscal year.

Still, it faces significant exposure to tariffs. Nike said tariffs will increase its costs by $1 billion this fiscal year and plans to pass through some of these costs with "surgical" price increases on its products this fall.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<