Indian markets remain rangebound with the Nifty trading near key support. The three-day RBI MPC meeting begins today.

Indian markets opened higher on Wednesday, with the Nifty index hovering above the crucial support level of 24,500.

Meanwhile, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) begins its three-day meeting today. Markets are pricing in a 25 basis points rate cut on Friday.

At 9:45 a.m. IST, the Nifty 50 had risen 42 points to 24,584, while the Sensex was up 131 points to 80,869.

Broader markets underperformed, with the Nifty Midcap and Smallcap indices falling by 0.3%.

Meanwhile, the India Volatility Index (VIX), a key gauge of market fear, fell 4%.

Analysts advise traders to adopt a wait-and-watch mode as option premiums remain high and directional conviction is weak.

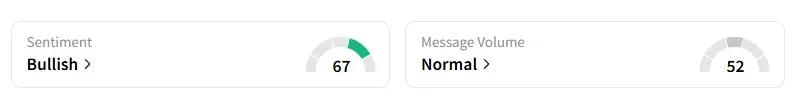

However, the retail sentiment on Stocktwits remained ‘bullish’.

Sectorally, gains were led by media, auto, and tech stocks, while PSU banks and realty stocks saw selling pressure.

Bharti Airtel emerged as the top Nifty gainer after Macquarie raised its price target to ₹2,050, citing stronger free cash flows and improving return on capital.

M&M also climbed 1% following a bullish outlook from Morgan Stanley, which sees up to 20% upside from current levels with a target of ₹3,668.

Aditya Birla Fashion fell 10% after a 6.2% equity stake reportedly changed hands in a block deal.

Indegene slipped 5% after a 10.56% equity transfer, while Tata Technologies and Alkem Labs declined 2% on similar block deal activities.

After its psoriasis drug candidate failed to meet its primary trial objective, Sun Pharma shares declined by 1%, while SPARC's shares plummeted by 17%.

From a technical standpoint, a SEBI-registered analyst on Stocktwits shared the trade setup.

A&Y Market Research pegs Nifty resistance between 24,746 and 24,811 and support at 24,455-24,507.

For Bank Nifty, they see intraday resistance at 55,930-56,050 and support between 55,443-55,557.

Globally, Asian markets traded higher on the back of strong U.S. jobs data, even as investors digested fresh U.S. tariff hikes on steel and aluminum imports.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<