According to TheFly, the brokerage also raised the price target for the stock to $11 from $9, implying an upside of 33% compared with Monday’s closing price.

NextDecade (NEXT) stock saw a surge in retail chatter on Tuesday after TD Cowen upgraded the stock to ‘Buy’ from ‘Hold.’

According to TheFly, the brokerage also raised the price target for the stock to $11 from $9, implying an upside of 33% compared with Monday’s closing price.

The brokerage reportedly said that it has "line-of-sight" to Rio Grande LNG, sanctioning not only the fourth liquefaction train but also Train 5. TD Cowen also noted that NextDecade should provide additional financial transparency about the project after the final investment decision, bolstering investor confidence.

The analysts at TD Cowen see potential for NextDecade to continue contracting volumes for additional trains, as the sale and purchase agreement (SPA) market for liquefied natural gas remains active, with the industry potentially moving beyond near-term weakness.

Top LNG producer Shell has predicted that global LNG demand will rise by about 60% by 2040 from current levels, driven by growing demand in Asian economies, efforts to reduce emissions, as well as the expansion of artificial intelligence data centers. The outlook bodes well for companies like NextDecade, which signs long-term deals with customers.

Earlier this month, the company roped in engineering firm Bechtel to build the two additional liquefaction trains at its Rio Grande LNG facility, which will boost the export project’s capacity by 9 million tonnes per annum (MTPA). The company expects to achieve a favorable final investment decision on Train 4 before Sept. 15.

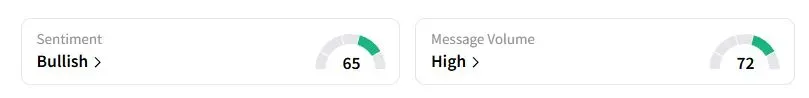

Retail sentiment on Stocktwits was in the ‘bullish’ (65/100) territory, while retail chatter spiked 1700%.

“We need more fuel to go higher. The missing SPA for Train 5 would get us there,” one user wrote.

NextDecade stock has gained 17.8% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<