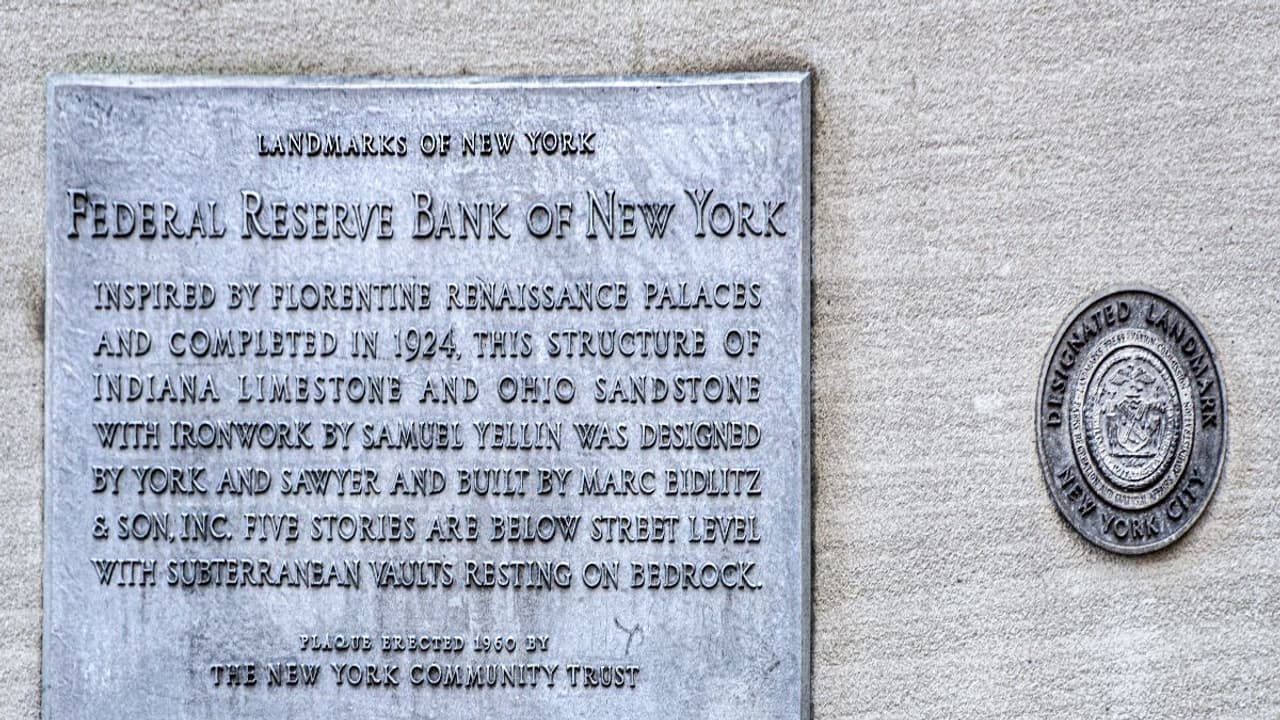

According to the December 2024 Survey of Consumer Expectations conducted by the Federal Reserve Bank of New York’s Center for Microeconomic Data, median inflation expectations rose to 3.0% from 2.6% at the three-year horizon.

A New York Federal Reserve survey indicated that U.S. consumers’ inflation expectations rose over the medium term but declined over a five-year horizon.

According to the December 2024 Survey of Consumer Expectations conducted by the Federal Reserve Bank of New York’s Center for Microeconomic Data, median inflation expectations rose to 3.0% from 2.6% at the three-year horizon but reduced to 2.7% from 2.9% at the five-year horizon.

The survey indicated that the increase at the three-year horizon was broad-based across age, education, and income groups. “However, the decline at the five-year horizon was driven by respondents below age 40 and was most pronounced for those with a high-school education or less,” it said.

Even the uncertainty expressed regarding future inflation outcomes increased at the one- and three-year horizons and declined at the five-year horizon.

The survey results also come just days ahead of the December inflation report. The U.S. jobs report released on Friday showed job growth was stronger than expected, dampening expectations of any potential early rate cuts by the Fed.

Non-farm payrolls rose by 256,000 in December, up from 212,000 in November and above an estimated 155,000. Following the strong jobs data release, markets worldwide traded in the red.

On Monday, the S&P 500 and the Nasdaq continued to trade lower. The SPDR S&P 500 ETF Trust (SPY) traded 0.55% lower, while the Invesco QQQ Trust, Series 1 (QQQ) traded over 1% lower on Monday. Retail sentiment on Stocktwits ranged from ‘bullish’ to ‘neutral’ for these ETFs.

Meanwhile, the survey also indicated that median expected growth in household income declined by 0.3 percentage point to 2.8%, the lowest reading since May 2021.

However, household spending growth expectations rose by 0.1 percentage point to 4.8%, remaining well above pre-pandemic levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<