Barclays highlighted Netflix's "defensive" appeal in the current macro environment and said visibility is high, which will likely help sustain the stock's premium valuation.

Netflix, Inc. (NFLX) stock received several price target hikes from sell-side analysts after the streaming giant reported forecast-beating first-quarter results and issued upbeat forward commentary.

Following the earnings report, Netflix stock climbed 3.47% in the after-hours session.

Analysts Ratchet Up Expectations

According to The Fly, the following analysts raised Netflix's stock price target:

- Guggenheim Securities maintained a 'Buy' rating and upped the price target to $1,150 from $1,100.

- BMO Capital Markets maintained an 'Outperform' rating and raised the price target to $1,200 from $1,175.

- Barclays maintained an 'Equal Weight' rating and increased the price target to $1,000 from $900.

- MoffettNathanson maintained a 'Buy' rating and raised the price target to $1,150 from $1,100.

- Oppenheimer maintained an 'Outperform' rating and increased the price target to $1,200 from $1,150.

- Pivotal Research maintained a 'Buy' rating and increased the price target to $1,350 from $1,250.

Citing the better-than-expected quarterly results and positive guidance, Guggenheim analysts said they see a "long runway for growth." BMO looks ahead to Netflix's ad tier, continuing to scale, driven by growth in engagement, pricing levers, and programmatic capabilities.

The brokerage sees a multi-year "durable" ad growth opportunity ahead for Netflix.

Barclays highlighted Netflix's "defensive" appeal in the current macro environment and said visibility is high, which will likely help sustain the stock's premium valuation.

Q1 Results

Netflix reported earnings per share (EPS) of $6.61 on revenue of $10.54 billion for the first quarter of 2025, exceeding the consensus estimates of $5.68 and $10.50 billion compiled by Finchat.

The company attributed the better-than-expected results to slightly higher subscription and ad revenue, and the timing of expenses. It raised subscription pricing in January, with the ad-supported service now priced at $7.99 per month, up $1, and the premium package price increased by 9% to $24.99.

However, year-over-year (YoY) revenue growth decelerated to 12.5% from 16% in the fourth quarter.

The company has decided to discontinue reporting membership metrics, effective in 2025.

Netflix said it launched its ad tech platform in the U.S. on April 1, with plans to roll out the platform in other countries in the coming months.

Looking ahead, Netflix expects second-quarter EPS of $7.03 and revenue of $11.04 billion, marking an estimated 15.4% growth. Analysts, on average, estimate $6.73 and $10.96 billion.

The company said it was improving its series and film offerings, growing its ads business, and further developing newer initiatives like live programming and games while sustaining healthy revenue and profit growth.

Netflix maintained its full-year 2025 revenue guidance of $43.5 billion to $44.5 billion, versus the $44.33 billion consensus, and its operating margin of 29%.

A Wall Street Journal report said earlier this month that Netflix executives sounded upbeat at an March annual review meeting. They expect revenue to double and operating income to triple by 2030 as the company targets the coveted $1 billion market cap mark.

On the earnings call, Co-CEO Gregory Peters delved into the macroeconomic impact: "We haven't seen any significant changes in plan mix or planned take rate."

He added that engagement remained strong and healthy. The executive also talked up the company's resilience.

Netflix said that Reed Hastings has transitioned from executive chairman to chairman of the board and non-executive director as part of a natural leadership succession.

Retail Cheers

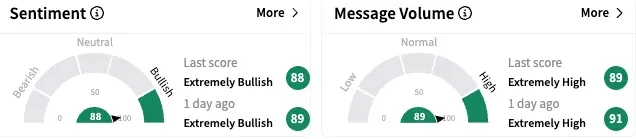

Retail watchers on the Stocktwits platform stayed 'extremely bullish' (88/100) on Netflix stock, and the message volume remained 'extremely high.'

A bullish watcher said a break above $1,064 could send Netflix stock soaring.

Another user persisted with their call for a stock split.

One user lauded the stock as the only one immune to tariffs.

Netflix ended Thursday's session up 1.19% at $973.03, taking its year-to-date gains to 9.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<