Wall Street has gotten more bullish on Micron’s stock after its Q3 results, citing AI-chip demand fueled by data center growth and improved margins as key performance drivers.

Wall Street analysts raised their price targets on computer memory and storage technology company Micron Technology Inc. (MU) following better-than-expected third-quarter earnings and an upbeat guidance.

Micron's third-quarter (Q3) revenue jumped 36.5% year-over-year (YoY) to $9.3 billion, well above the consensus estimate of $8.85 billion, according to Finchat data.

The adjusted earnings per share (EPS) of $1.91 also surpassed the consensus estimate of $1.6. Micron Technology stock inched 1.9% higher in the pre-market on Thursday, on track to hit a one-year high.

Stifel increased its price target on Micron to $145 from $130 while maintaining a ‘Buy’ rating, as per TheFly. The research firm acknowledged that some of the Q3 shipment strength came from early demand, but management considers that influence to be limited.

The brokerage also raised projections, anticipating broader price improvements through September and continued favorable product mix through the end of the year.

JPMorgan lifted its price target to $165 from $135, reiterating an ‘Overweight’ rating on the stock. The brokerage attributed the strength to demand for high-bandwidth memory and data center products, as well as continued momentum in consumer markets.

JPMorgan also raised its forward projections and remains optimistic about Micron’s positioning for the latter half of 2025.

Piper Sandler boosted its price target to $165 from $120, while maintaining an ‘Overweight’ rating.

Piper believes Micron stands to gain significantly from current trends in AI and data centers, thanks to its high-bandwidth memory (HBM) offerings and strategic market position.

Rosenblatt increased its price target to $200 from $172 and reiterated its ‘Buy’ rating. In a note to investors, the research firm credited rising demand for dynamic random access memory (DRAM), fueled by AI applications, along with Micron’s top-tier power efficiency, for significantly pushing revenue, margins, and earnings above forecasts.

The brokerage believes this upcycle could elevate Micron’s earnings model to record levels, noting that any meaningful DRAM wafer capacity expansion remains at least 18 months out.

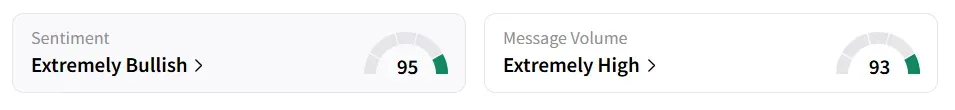

On Stocktwits, retail sentiment around Micron improved to ‘extremely bullish’ from ‘bullish’ the previous day. Message volume gained traction to ‘extremely high’ from ‘high’ levels 24 hours earlier.

Micron Technology stock has gained over 51% in 2025 and lost over 10% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<