The Finchat-compiled consensus estimates model earnings per share (EPS) of $5.21 and revenue of $41.36 billion for the first quarter of the fiscal year 2025.

Social media giant Meta Platforms (META) is scheduled to report quarterly results after the market closes on Wednesday.

Meta stock is down over 5% this year due to the macroeconomic uncertainty triggered by President Donald Trump's tariff announcement in early April, which has stirred fears of an imminent recession in the U.S. and heightened inflationary pressure.

The Finchat-compiled consensus estimates model earnings per share (EPS) of $5.21 and revenue of $41.36 billion for the first quarter of the fiscal year 2025. A year ago, the company reported EPS of $4.71 and revenue of $36.45 billion.

Meta's guidance, issued in late January, called for first-quarter revenue of $39.5 billion and $41.8 billion. It projected 2025 capital expenditures of $60 billion to $65 billion, up from $39.23 billion in 2024, with the anticipated spike attributed to increased investment in generative artificial intelligence (GenAI) efforts and core business.

Advertising revenue makes up over 95% of Meta's topline.

The spotlight is also on key operating metrics such as daily active people (DAP) across Meta's family of apps, ad impressions, and average price per ad. In the previous quarter, these metrics increased 5%, 6%, and 11%, respectively, year over year.

Looking ahead, on average, analysts estimate EPS and revenue of $5.21 and $43.81 billion, respectively, for the second quarter,

Investors may also stay tuned to qualitative commentary on the ad spending environment. Morgan Stanley analyst Brian Nowak, however, sees very little impact. He sees performance-based platforms such as Meta as better positioned to offset ad auction bid density weakness.

Smaller peer Snap (SNAP) whined about a slowdown in advertising spending early in the second quarter due to tariffs and refrained from giving an outlook, citing macroeconomic uncertainty. However, Alphabet (GOOG) shrugged off any ad spending slowdown when it reported earnings last week.

On Tuesday, Meta released a standalone AI app built on the Llama 4 large language model (LLM) to compete with OpenAI's ChatGPT.

On Stocktwits, retail sentiment toward Meta stock turned 'bullish' (59/100) by late Tuesday from the 'neutral' mood seen a day ago. The message volume, however, stayed 'normal.'

A bullish watcher said the Meta stock is now extremely oversold.

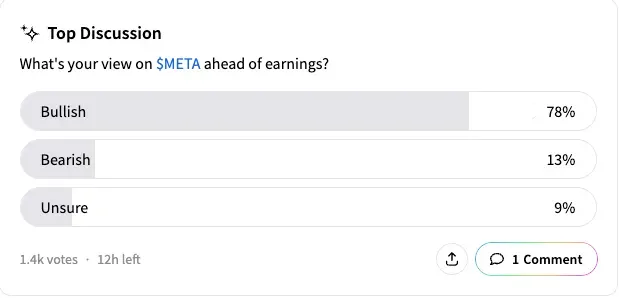

An ongoing Stocktwits poll that asked users their views on the Meta stock ahead of earnings found that 78% of the respondents were bullish.

On Monday, Loop Capital reduced its price target for the Meta stock to $695 from $900 but maintained a 'Buy' rating, The Fly reported.

The firm expected solid earnings but looked forward to soft guidance as Chinese cross-border advertisers cut back on marketing to U.S. consumers amidst closing the de minimus exemption and tariffs.

Loop also noted the softening of click-throughs and other consumer demand signals.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<